Virginia Del. Richard “Rip” Sullivan Jr. is one of the General Assembly‘s biggest advocates for electric vehicles. But when the Fairfax County Democrat went to buy a car in 2018, he started feeling anxious about the electric cars on offer — particularly their relatively limited range, given the lack of electric vehicle (EV) chargers in the commonwealth.

“My local travels and commutes in-district would be perfect,” Sullivan says, but he got nervous thinking about his regular drives to Richmond for legislative business. “So, I blinked, and did not get my EV.” Instead, he bought a gas-powered Hyundai Elantra.

Sullivan told that story on the Virginia Capitol floor during the 2021 session. Electric vehicles, also known as EVs, have progressed in leaps and bounds in the year and a half since then — and Sullivan’s anxiety likely will completely evaporate by the time he buys his next car.

Manufacturers have gone all in on EVs. In a Super Bowl ad this year, General Motors Co. committed to an all-electric lineup by 2035. Last fall, Ford Motor Co. announced it would build would build a manufacturing campus in Tennessee to make an electric F-150 pickup and batteries for the vehicle, plus two more vehicle battery plants in Kentucky. Rivian Automotive Inc. and Hyundai Motor Co. both announced new electric vehicle factories in Georgia. Toyota Motor Corp. will build an electric vehicle battery plant in Greensboro, North Carolina. And Mercedes-Benz U.S. International is adding an EV assembly line at its Alabama plant, while Virginia-headquartered Volkswagen Group of America began production of an electric compact SUV at its Tennessee factory in July.

The federal government is getting in on the act, too. In November 2021, President Joe Biden signed into law the $1.2 trillion Infrastructure Investment and Jobs Act, which will make available nearly $5 billion for states to build out a coast-to-coast network of 500,000 electric vehicle charging stations by 2030. Virginia’s share is $106 million over five years, beginning with a $15.7 million installment in fiscal 2022.

That investment will “enable families to make the transition to electric and get where they need to go safely and efficiently,” says U.S. Sen. Mark Warner. “Electric vehicles offer a clean and affordable alternative to traditional fuel vehicles. That’s one of the reasons I worked so hard to negotiate and pass our bipartisan infrastructure law, which included a record investment in electric vehicle charging stations.”

U.S. Sen. Tim Kaine is still calling for Congress to do more to spur the production and purchase of electric vehicles.

“Transportation is the largest source of greenhouse gas emissions in both Virginia and the United States,” Kaine says. “That means if we’re going to be serious about addressing climate change to protect Virginians from more torrential flooding and the dangers of rising sea levels, we need to do everything we can to make it easier for people to get from Point A to Point B in a more sustainable way.”

Sparking investment

The February announcement of the EV charging infrastructure funding prompted states to draw up their plans to build out their EV charging networks ahead of an August deadline — essentially the starting gun in a race to pave the way for electric vehicles.

Details around commercial electric vehicle charging are hazy so far. Many EV owners charge at home, but beyond that, the process quickly gets tricky. Some developers have added EV chargers at apartment complexes and shopping centers, but these vary. Some are universal chargers, and some are model-specific. Some stations charge much more rapidly than others. And some require payment to charge, while others are free.

Toward this end, Roanoke-based Virginia Transformer Corp. is manufacturing its E2V large-scale power modules (approximately 14,000 pounds and 8 feet by 9 feet by 14 feet) that commercial clients can use to develop custom commercial vehicle chargers. Each E2V unit includes multiple components needed to build charging stations, including transformers, switchgears, distribution circuits and breakers.

Another Virginia company that’s moving to fill the gap for EV chargers is Reston-based Electrify America. Volkswagen, which has its North American headquarters in Fairfax County, established the subsidiary company in 2016 after a highly publicized emissions scandal in which VW admitted cheating on U.S. emissions tests.

Electrify America has installed more than 800 charging stations with more than 2,500 chargers across 46 states. The company partners with Kia Corp., Hyundai and Ford to offer complimentary charges for some vehicle models. (Read more about Electrify America in our September 2022 cover story.)

The federal infrastructure bill should significantly boost the availability of chargers like those around the nation. Details of Virginia’s plan to access federal funding weren’t available as of early August, but federal officials generally seek to place EV chargers at least every 50 miles along interstates and major highways.

Virginia has a little bit of a policy head start on its Southeastern peers when it comes to electric vehicles.

During their two years in control of state government, Virginia Democrats passed landmark laws to decarbonize the state power grid by 2050 and begin the process of cutting vehicle emissions. In 2021, the General Assembly passed a law to implement a low- and zero-emissions vehicle program by adopting California’s emissions standards and electric vehicle sales targets.

The Virginia Automobile Dealers Association came out in support of the EV laws. VADA President Don Hall released a public statement during the 2021 session that was targeted as much at the organization’s members as it was lawmakers.

“As a dealer in Virginia, if you aren’t convinced EVs are your future, look at GM’s announcement of an all-EV fleet come 2035,” Hall wrote. “Look at your manufacturers and the direction they are headed. Start preparing. EVs are here to stay.”

State lawmakers also established a rebate program to lower the upfront cost of electric vehicle purchases but failed to budget any funding for it. Advocates’ hopes for new EV funding and legislation took a hit when Republicans won control of the governor’s mansion and the House of Delegates in the 2021 elections, but the ensuing General Assembly session hinted at the potential for bipartisan compromise.

Youngkin spokesperson Macaulay Porter points to a bill carried by Sen. T. Montgomery “Monty” Mason, D-Williamsburg, that encourages state government to purchase EVs if their lifetime cost is cheaper than gas vehicles.

“The governor knows that we can bring down emissions in Virginia with a common-sense approach that protects our natural resources and economic interests,” Porter says. “The administration continues to emphasize the importance of these products and this industry in our ongoing economic development strategy.”

Sullivan and Sen. Dave Marsden, D-Fairfax, co-sponsored legislation this year to establish a transportation decarbonization program to disburse up to $20 million annually in grants for private developers to install EV charging stations, covering 50% of nonutility costs in most localities and 70% in economically disadvantaged communities.

The bill didn’t survive budget negotiations, “but it spurred debate about how we implement infrastructure in rural areas,” says former state Del. Greg Habeeb, now a lobbyist and president of Richmond-based Gentry Locke Consulting.

“When people talk about electric vehicles and think about Teslas and people charging them in their garages, that’s great, but it’s really a tiny, tiny fraction of the public,” Habeeb says. That’s why the policy conversation is evolving to include consideration of multifamily rental housing and rural areas, he explains — “not highway corridors, not McLean [in Northern Virginia], but really getting into urban environments, rural environments [and] underserved environments.”

Sullivan and Marsden’s bill attracted bipartisan support. A related budget amendment by Del. Terry Kilgore, the House GOP majority leader, for rural charging infrastructure drew a handful of Republican votes in both chambers, but ultimately fell by the wayside after federal infrastructure money was announced for charging networks.

“That became a reason not to do anything at the state level,” Habeeb says.

The federal infrastructure money is intended to establish a network of chargers along interstates and major highways, easing “range anxiety” and encouraging more people to buy electric vehicles.

“The key is to get enough infrastructure so people buy vehicles, and the market can become self-sustaining, and then government doesn’t have to be involved anymore,” Habeeb says.

But, he says, that federal funding excludes many rural and urban areas not located along primary highway corridors. State incentives for “economically disadvantaged” areas in the Marsden/Sullivan bill were aimed at getting private developers to target those places, but once the federal money became available, state lawmakers put those considerations on hold.

Powerful advocate

Electric utilities like Dominion Energy Inc. also have some ideas about how the EV charger network buildout should be handled. Kate Staples is Dominion’s electrification manager. Part of her job entails helping people and businesses transition from gasoline and diesel vehicles, as well as from propane or natural gas in homes and factories.

Dominion has three priorities regarding EVs: Ease the process for customers to switch; expand access to charging infrastructure; and ensure the utility can meet growing demand with a grid increasingly powered by renewable energy sources such as wind and solar.

Dominion has been working with Virginia officials to assist in developing the state charger plan to receive federal infrastructure funding. The utility is also working with private companies to deploy chargers now.

For example, she says, Dominion “partnered with The Current, a mixed-use development in [Richmond’s] Manchester area with apartments and office space, to provide electric vehicle charging stations for tenants.” Dominion provided about half of the development’s 50 charging stations, which residents can use without additional fees.

Tension is already developing between Virginia’s monopolistic, regulated electrical utilities and its gas stations, which tend to be owned by independent franchisees. Gas stations might profit by adding chargers and selling high-margin retail goods to customers who are waiting for their cars to charge. But station owners are faced with the uncertain prospect of investing in chargers before the market has clearly taken shape.

“Our gas station clients are not aggressively proposing a shift toward EVs,” Habeeb says. “They want to find a way to preserve businesses for their families. I’m cynical about the role of utilities. Tomorrow, if you took every gas-powered vehicle off the road and replaced it with an EV, that would drive huge demand, deployment and distribution. All of that is investment for utilities to get a [guaranteed] return on.”

Staples, of course, sees it differently.

“I am an electric vehicle driver,” says the Dominion executive. “I charge at my house, so every morning I wake up with a full … tank. A gas driver can’t do that, so they have to go to gas stations. There needs to be significantly more gas stations than charging stations, because everyone can fuel up on electricity at home or a business.”

While Dominion Energy and Gentry Locke’s gas station-owning clients differ on the best ways to build charging infrastructure, they’re more aligned when it comes to electrifying school buses.

In 2019, Dominion launched an initiative to help Virginia school districts replace diesel buses with electric models. In its first phase, 15 localities received 50 electric buses that have clocked more than 300,000 miles so far. The U.S. Environmental Protection Agency also is assisting with the transition. It named more than 80 Virginia school districts as “priority” recipients for its $500 million Clean School Bus Program.

The program funds about $375,000 toward each bus, and another $20,000 for charging, although it can vary by school district. In April, the program awarded $1.5 million to five Virginia school districts to replace 32 old diesel buses.

Replacing diesel buses makes a big difference in air quality. One diesel bus emits more than 54,000 pounds of greenhouse gases each year, according to Dominion — and air quality inside a diesel bus is five times worse than outside. Additionally, electric buses build grid stability because they can be used as batteries when not in use. EV makers are making this part of their pitch: Ford, for example, says the batteries in its electric F-150s can be used to power homes for days in the event of a grid outage.

Meanwhile, Campbell County bus dealer Sonny Merryman Inc. has started selling electric school buses, including to its home county, with the aid of an Appalachian Power grant.

“While this technology is still in its infancy, I think we can all agree it is the future of human mobility and global sustainability,” Sonny Merryman Executive Chairman Floyd Merryman III said during the ribbon-cutting event.

Energetic outlook

Other companies also are investing in electric vehicles with massive economic development announcements entailing enormous incentives and thousands of jobs. Virginia’s Southeastern U.S. peers have snatched a disproportionate share of these factories, including the neighboring states of Kentucky, North Carolina and Tennessee. Georgia pledged $1.5 billion in incentives to land a $5 billion Rivian EV assembly plant, and $1.8 billion in incentives for a $5 billion Hyundai EV plant — the latter of which nearly landed at the Southern Virginia Megasite at Berry Hill in Pittsylvania County, according to Danville Economic Development Director Corrie Bobe, adding that “making it to the final stage shows how well prepared the Southern Virginia Megasite is for large-scale manufacturing.”

The General Assembly approved $150 million in its budget this year to shore up utility infrastructure at sites such as the Southern Virginia Megasite. That may not sound like much, compared with the incentives Georgia is paying, but infrastructure improvements can help attract smaller companies in the EV supply chain — or in the supply chains for Virginia’s rapidly growing solar and wind energy industries. Or, for that matter, to entice companies like Amazon.com Inc. or Google LLC, which may not be directly involved in energy but want EV chargers and renewables to attract a talented, savvy workforce.

“That’s where we’ve been behind,” Marsden says. “These other states are ready to go. We haven’t been.”

That doesn’t mean Virginia hasn’t had EV-related wins.

Volkswagen announced in 2020 it had signed a lease to move its North American headquarters from Herndon to a 196,000-square-foot space at Reston Town Center. The German auto manufacturer is moving into the electric vehicle space in a big way, announcing a $7 billion investment in North America to boost its digital and electric technology over the next five years. That includes a battery lab in Chattanooga, Tennessee, where it also began producing its electric flagship ID.4 SUV in June.

Volvo Trucks, which manufactures all its North American tractor-trailer trucks in Pulaski County, set a global target to have electric vehicles account for half its truck sales by 2030. The Pulaski plant is contributing toward that target by making electric trucks, although Electromobility Product Marketing Manager Andy Brown says Volvo’s trucking customers also want vehicles that can run on hydrogen and cleaner diesel fuels.

Volvo announced in 2019 it would invest nearly $400 million to upgrade the Pulaski County plant, with a portion of that going to prepare for more electric production, says Mary Beth Halprin of Volvo Group North America. By 2022, the company had sold 62 models of its electric VNR truck.

“We prepared and adjusted our production processes, so that we are assembling all powertrain variants of the Volvo VNR (battery-electric, compressed natural gas, diesel) on the same assembly line,” Halprin says. “There was specific training developed so that the battery-electric trucks could be — and are — assembled by the same skilled, trained employees who assemble all VNR models.”

In addition to the huge investments being made by global automakers like Volvo and Volkswagen, perhaps the greatest predictor of EVs’ success is the fact that their economic development potential has brought Democrats and Republicans together in other Southeastern states. Lawmakers who usually are at odds are finding bipartisan consensus around deals that carry billions in investments and create thousands of well-paid manufacturing jobs.

While electric vehicles might still feel futuristic, their ability to bring political parties together seems like the most obvious indicator of their coming ubiquity on American highways.

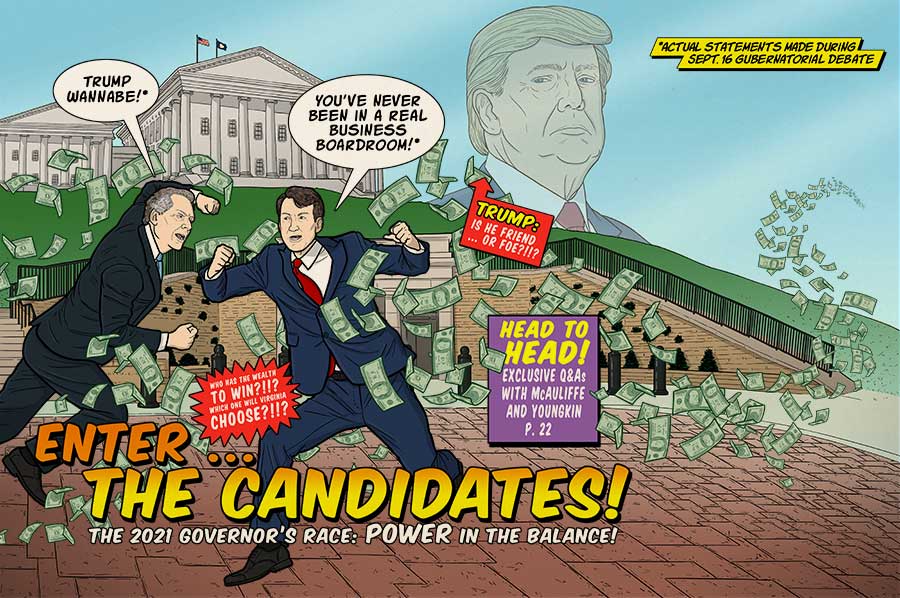

Youngkin, a first-time political candidate and former co-CEO of Washington, D.C.-based private equity firm The Carlyle Group, triumphed over better-known candidates to win the

Youngkin, a first-time political candidate and former co-CEO of Washington, D.C.-based private equity firm The Carlyle Group, triumphed over better-known candidates to win the