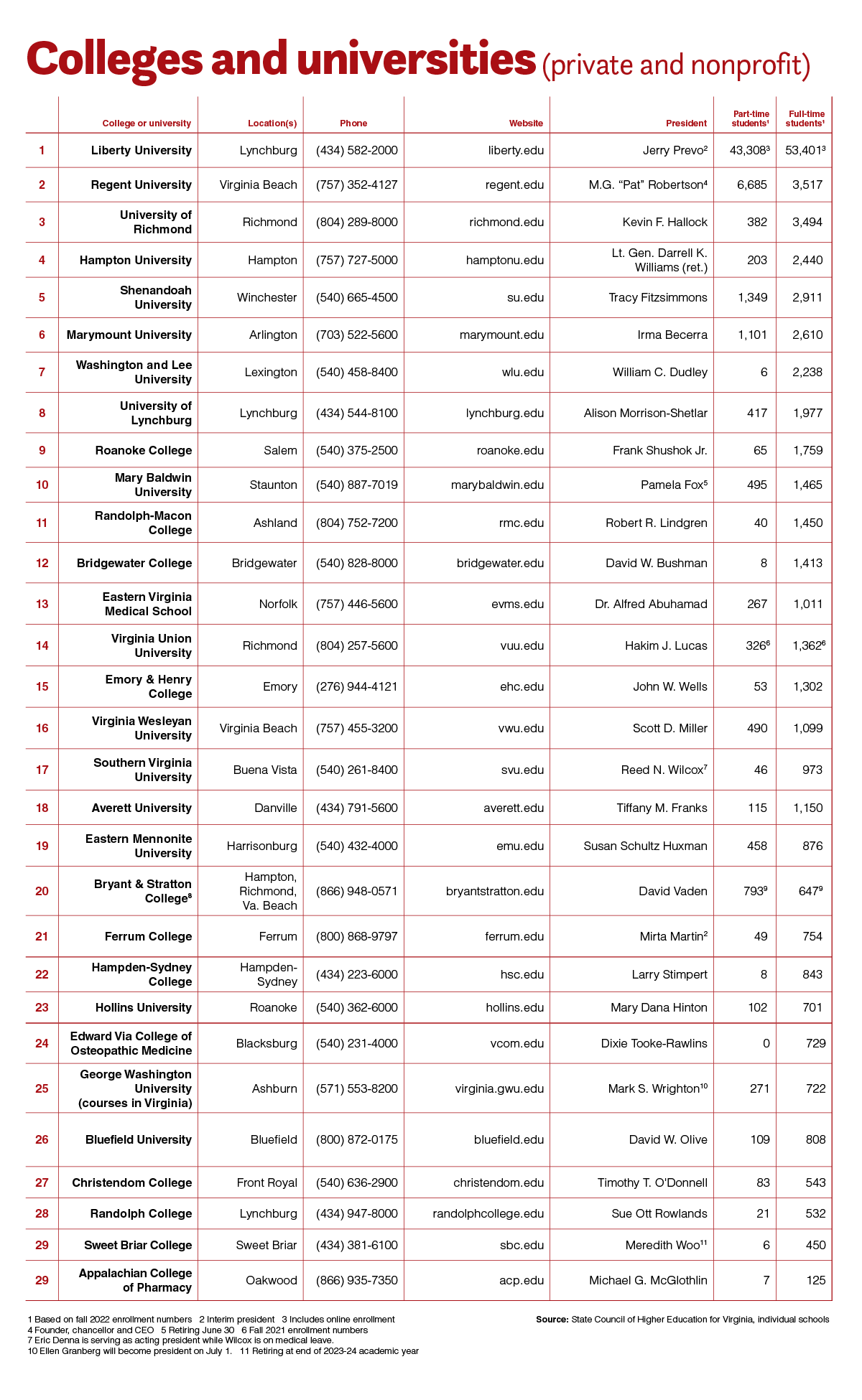

Liberty University‘s board has appointed retired Air Force Maj. Gen. Dondi E. Costin as its next president and Pastor Jonathan Falwell as chancellor, with both men starting in those posts before the 2023-24 school year, the Lynchburg-based private Christian university announced Friday.

Costin, who earned two master’s degrees from Liberty, is currently president of Charleston Southern University in South Carolina, which he has led since 2018, and also president of the Big South Conference. He served in the Air Force for 32 years, ending his career as the military branch’s chief of chaplains while stationed at the Pentagon. Costin replaces Liberty’s interim president and former board chairman, Jerry Prevo, who will transition to president emeritus, according to Liberty’s announcement.

“As one whose life and ministry have been profoundly shaped by Liberty University, I can think of no educational institution with more global impact than my two-time alma mater. I am beyond grateful to the board for entrusting me with this extraordinary opportunity,” Costin said in a statement. “Vickey and I look forward to locking arms with the Liberty family as we honor the university’s past and drive toward its future. With God’s help and for his glory, the very best days of our great university are still ahead of us.”

Costin has two doctorates from the Southern Baptist Theological Seminary and five master’s degrees, including one in counseling from Liberty and one in religion from Liberty Baptist Theological Seminary. He is also a decorated combat veteran and as president of CSU, Costin oversaw construction of several new buildings and expansion of its academic offerings, including South Carolina’s only four-year aviation program, multiple doctoral programs and an engineering program in the university’s College of Science and Mathematics, according to Liberty’s announcement.

Falwell, who will remain as senior pastor of Thomas Road Baptist Church, is the brother of former Liberty President Jerry Falwell Jr., who became Liberty’s president and chancellor in 2007 and resigned in 2020 amid a highly publicized personal scandal. Both are the sons of the late Jerry Falwell Sr., who founded Liberty in 1971 as Lynchburg Baptist College and was the university’s first president and chancellor, as well as the founder of Thomas Road Baptist. A two-time Liberty alumnus, Jonathan Falwell is currently Liberty’s executive vice president for spiritual affairs and campus pastor, and previously held the title of vice chancellor for spiritual affairs.

According to a 2022 Vanity Fair feature, the Falwell brothers were divided politically over Falwell Jr.’s endorsement of Donald Trump’s presidential bid in 2016, with Jonathan Falwell supporting U.S. Sen. Ted Cruz, as well as having very different personalities and temperaments. Earlier this month, Falwell Jr. filed a federal lawsuit against Liberty over $8.5 million in retirement benefits he alleges he is owed.

Both Falwell and Costin will report independently to the university’s board of trustees. Executive recruiting firm CarterBaldwin led an eight-month national search on behalf of the presidential and chancellor search committee, which was chaired by the late Gilbert “Bud” Tinney Jr., a board member who died at the age of 85 in February.

“With CarterBaldwin’s objective help, we looked near and far, and we believe we have found the right leaders at the right time for the future of Liberty University,” Board Chairman Tim Lee said Friday. “The combination of President Costin and Chancellor Falwell not only bring the gravitas and experience necessary to lead the university exceptionally well, but with perfect cultural alignment.”

Prevo, a former pastor of Alaska’s Anchorage Baptist Temple, stepped in as interim president in August 2020, when Jerry Falwell Jr. resigned as president and chancellor after media reports of controversies, including allegations that he had knowledge of an affair between his wife and a young man who also was their business partner briefly. Falwell has denied that allegation, but the university sued him for $10 million for breach of contract. He also has countersued, seeking the return of some legal documents, a revolver he kept in his desk and other personal items he says the university has not allowed him to collect since banning him from Liberty property. Those lawsuits are still underway in Lynchburg Circuit Court. The university also launched a third-party investigation of the university’s finances and real estate dealings during Falwell’s tenure in late 2020, but no report has been publicly released.

In addition to the Falwell Jr. scandals, Liberty was sued by 22 anonymous women — both former students and staff members — who alleged that Liberty “intentionally created a campus environment where sexual assaults and rapes are foreseeably more likely” and discouraged victims from reporting their assaults. In May 2022, 20 of the plaintiffs settled their lawsuits against Liberty, and the U.S. Department of Education announced the same month that it is investigating the university over claims of Title IX misconduct.

Despite the controversies, Liberty has remained financially healthy, with an endowment of $2.169 billion in fiscal year 2022, and the university is set to pay off more than $189 million in taxable bonds in April, according to paperwork filed March 1 by the Bank of New York Mellon Trust Co. NA.

Virginia’s largest university by enrollment, Liberty has grown into an online-learning juggernaut, with 95,148 students enrolled in 2021, most of whom study remotely, according to the university.