Last year, Virginia Beach inked a deal for an arena that it hopes will grab the attention of top entertainers as well as a major sports team looking for a new home. “It will be the largest arena in the state,” says Warren Harris, the city’s director of economic development.

The $200 million project planned by United States Management LLC (USM), includes an arena with seating for more than 15,000 people. The city will put up $78 million for infrastructure improvements and lease the land for 60 years to USM, an affiliate of The ESG Cos., a Virginia Beach development company.

“The closest arena in size would be the John Paul Jones Arena in Charlottesville [which has slightly fewer than 15,000 seats],” says Andrea Kilmer, the president and CEO of ESG. “Virginia Beach is a natural stop between Washington, D.C., and Raleigh, two markets that do have facilities large enough to accommodate top acts.”

Kilmer believes the new venue will help Virginia Beach attract concerts and shows that have bypassed the area in the past. Some touring groups, she says, are too large for current facilities in the area.

“Take the [rock singer] Pink, for example,” Kilmer says. “When she tours, she has 30 tractor-trailers and props that weigh over 130,000 pounds. She can’t come to an indoor facility in this region because none can handle her type of production.”

ESG became interested in the arena idea five years ago when the NBA’s Sacramento Kings considered moving to Virginia Beach. “They approached the city and looked into building an arena,” says Harris. “The Kings decided not to pursue Virginia Beach as an option.”

The cost of building an arena would have put a heavy financial burden on the city. But the team’s interest proved that the market could support a sports franchise. “I think that effort encouraged ESG to move forward,” Harris says.

In 2013 the company began examining a possible arena project in earnest. “We asked ourselves: Can you privately develop an arena and make it feasible?” Kilmer says.

The company met with a group of visiting Chinese businessmen to see whether it could work with a Chinese bank as a lender for the project. “We came up with a new model,” Kilmer says, noting that the company secured funding from the Export-Import Bank of China. “We told the city we will build it, finance it and operate it, but there are certain incomes we want to capture to help underwrite the infrastructure.”

Thus far, one of the most challenging issues has been explaining why a private owner would construct, own and operate a facility normally owned by a municipality.

“This is a new model for developing a ‘public’ facility without a national sports franchise,” Kilmer says. “We are motivated differently than a municipality to make the venue successful and solve operational challenges that arise as we do not have the authority to raise taxes to make up a shortfall but must remain creative in solutions so we can continue to employ area citizens, provide entertainment opportunities and give back to our hometown.”

ESG pulled in a mix of international and local team members for the project. They include CMEC, an international design, engineering and procurement specialist; Mortenson Construction, a national contractor now ranked as the second largest builder of sports facilities in the nation; Virginia-Beach based contractor S.B. Ballard Construction Co.; AECOM, an international architectural, engineering and design consultancy firm; Clark Nexsen, a local architecture, engineering, planning and interior design firm; and SMG, a venue management, marketing and development firm.

“They were all involved before the proposal went to the city last year,” says Kilmer. “They believe that this could possibly be a model that could work across the country.”

The arrangement is attractive to the city because “it’s privately funded and puts the financial burden on the private sector to reach its financial goals,” says Harris.

The Foreign Affairs Security Training Center (FASTC), a foreign-service training center for the U.S. Department of State, plans to spend more than $400 million on a training facility at Fort Pickett in Nottoway County. “When fully operational in 2020, it would train 8,000 to 10,000 people per year,” Reed says.

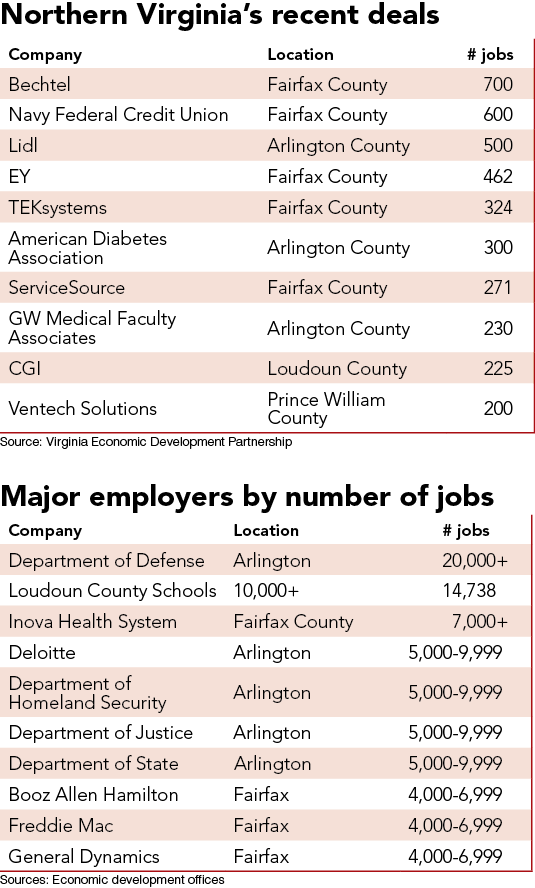

The Foreign Affairs Security Training Center (FASTC), a foreign-service training center for the U.S. Department of State, plans to spend more than $400 million on a training facility at Fort Pickett in Nottoway County. “When fully operational in 2020, it would train 8,000 to 10,000 people per year,” Reed says. One of the county’s high points occurred when Inova Health System took over the Exxon Mobil campus in the Merrifield area to house the Inova Center for Personalized Health. “This campus will make Fairfax County a hub for world-class research and the commercialization of ground-breaking discoveries,” Gordon says. “New companies will grow as a result, and more world-class researchers and businesses will want to be here.”

One of the county’s high points occurred when Inova Health System took over the Exxon Mobil campus in the Merrifield area to house the Inova Center for Personalized Health. “This campus will make Fairfax County a hub for world-class research and the commercialization of ground-breaking discoveries,” Gordon says. “New companies will grow as a result, and more world-class researchers and businesses will want to be here.”