Virginia data center tax reform passes House as other sales tax bills stall

State spent $5.2B in data center incentives over decade

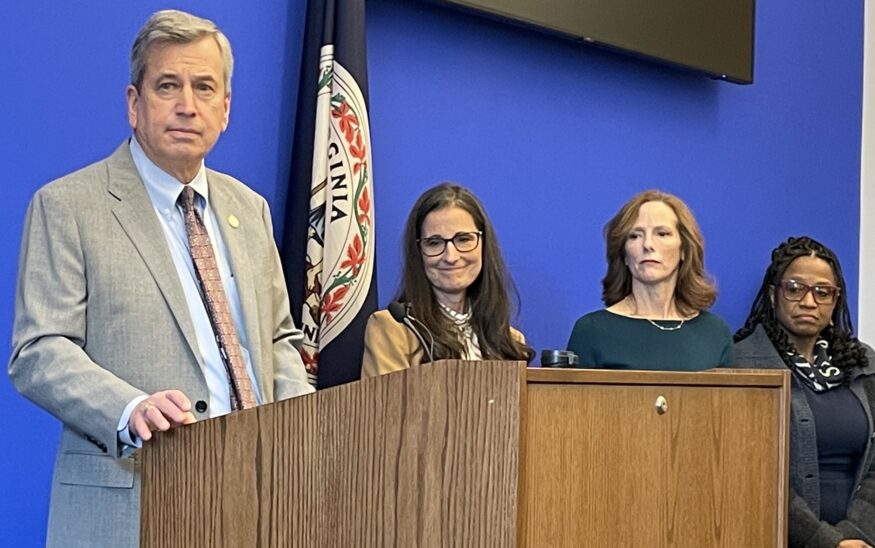

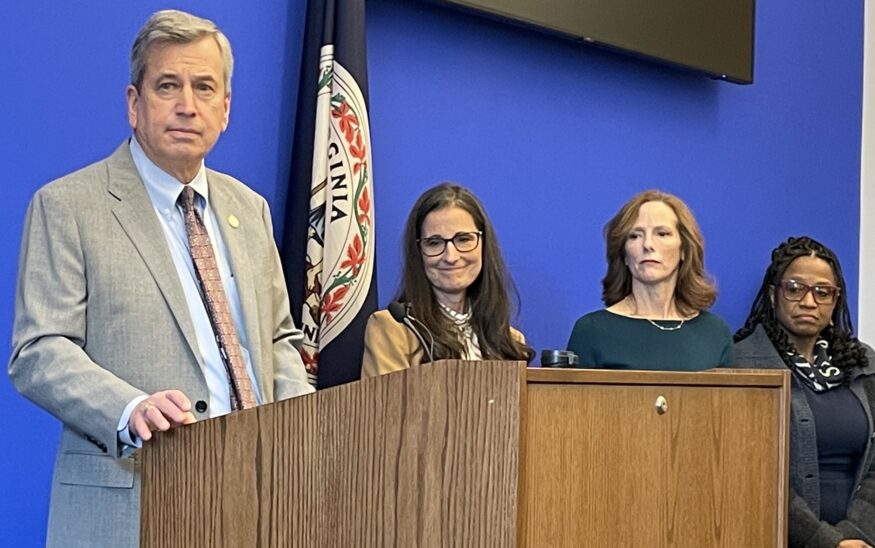

Del. Rip Sullivan at a press conference to advocate against the bills supporting a casino in Tysons Corner. Sullivan also sponsored several sales and use tax bills in the 2026 session. Photo by Alexa Barnes/VCU Capital News Service.

Del. Rip Sullivan at a press conference to advocate against the bills supporting a casino in Tysons Corner. Sullivan also sponsored several sales and use tax bills in the 2026 session. Photo by Alexa Barnes/VCU Capital News Service.

Virginia data center tax reform passes House as other sales tax bills stall

State spent $5.2B in data center incentives over decade

SUMMARY:

- Bill requiring data centers to use noncarbon emitting generators and demonstrate commitment to clean energy to receive state tax incentives passes House of Delegates

- Other tax bills fail in Virginia General Assembly session

RICHMOND — Two pieces of legislation introduced by Del. Rip Sullivan, D-Fairfax, to update the state’s sales tax were heard in the House and met with different outcomes.

House Bill 897 and House Bill 900, both patroned by Sullivan, looked to adjust Virginia’s sales and use taxes.

“Our sales and use tax structure is badly outdated in Virginia,” Sullivan said. “It’s been way too long since we’ve taken any real action to update it.”

HB 897 requires data centers to utilize noncarbon emitting generators and backup sources as well as demonstrate a commitment to clean energy in order to qualify for existing data center sales and use tax exemptions.

“HB 897 is built on a very simple premise — that if the data centers here in Virginia want this tax exemption, this enormously valuable tax exemption, they have to make good on their supposed commitment to us,” Sullivan said.

Virginia has incentivized data center development. The state gave $5.2 billion in tax incentives and grants between fiscal years 2015 and 2024, according to a 2025 report by the Joint Legislative Audit and Review Committee. During this period, data center and use tax exemptions totaled $2.7 billion, accounting for more than half of the state’s total incentive spending.

Freedom Virginia is a nonpartisan advocacy organization focused on affordability and financial stability for families across the commonwealth. Co-Executive Director Ryan O’Toole emphasized the importance of bills like HB 897 and holding data centers accountable.

“That’s nearly $2 billion the state did not make, that it could have otherwise used to make life more affordable for people by investing in affordable child care, affordable health care, affordable housing, all things that people are struggling with these days,” O’Toole said.

Freedom Virginia is not opposed to data centers.

“They’re a good economic development tool for the commonwealth,” O’Toole said. “But they should be paying for the energy that they use and the costs associated with that energy.”

HB 897 passed the House on a 61 to 34 vote.

State retail sales and use tax

Legislation regarding wider tax restructuring remains stalled over debate between Republicans and Democrats, despite headway with data center tax reform.

HB 900 aimed to decrease the state’s retail sales and use tax from 4.3% to 4% while expanding taxes to additional services like recreational and sports facilities, salons, dry cleaning and streaming services, among others. The bill also proposed a 20 cent delivery fee and additional transportation taxes in Northern Virginia.

“It’s inefficient, it’s inequitable and HB 900 … would modernize Virginia’s sales tax structure while lowering the overall sales tax around the commonwealth,” Sullivan said. “That would have direct benefits for residents as well as local and state economies, not to mention our aging infrastructure.”

HB 900 and legislation like it have been contentious among lawmakers. The bill, along with several others, were continued to 2027.

There was much debate around HB 978, sponsored by Del. Vivian Watts, D-Fairfax. The bill would have broadened the sales and use tax base to goods and services similar to those included in Sullivan’s measure, while eliminating the grocery tax.

Terry Rephann, a regional economist at the Weldon Cooper Center for Public Service, said such wholesale changes to tax codes were unlikely to succeed.

“There’s going to be a powerful constituency opposed to that, and that’s anyone that’s working in these industries,” Rephann said. “That’s a lot of folks, that’s a lot of workers, it’s a lot of business owners.”

However, many economists advocate for broadening the sales tax base to services for a variety of different reasons, according to Rephann.

“Because it’s more equitable to do that and also for practical reasons, and that is that an increasing percentage of the consumption is in these services,” Rephann said.

Senate Minority Leader Ryan McDougle, R-Hanover, flanked by Republican lawmakers at a press conference earlier in the month, spoke firmly against such expansion because it goes against the affordability Virginians need and Democrats campaigned on.

“The argument that the Democrats are making is if we make you pay taxes on more things, and that tax is higher and it takes more money out of your pocket, somehow that’s affordable,” McDougle said. “That is ridiculous.”

The bills proposing sales tax expansion would cost Virginians an estimated $765 in additional expenses, while Republicans say they have worked to reduce the tax burden.

“They are all simply necessitated in order to fund the budget-busting excesses of our friends on the other side,” said Sen. Mark Obenshain, R-Harrisonburg.

Even with progress on many of the tax bills halted this session, Rephann still expects to see an expansion of the state’s tax base at some point in the future.

“I think there will come a time when the revenue needs exceed the revenue capacity,” Rephann said.

Capital News Service is a program of Virginia Commonwealth University’s Richard T. Robertson School of Communication. Students in the program provide state government coverage for a variety of media outlets in Virginia.

t