Them’s the brakes

Top CEOs saw flat pay growth in 2022, with bonuses down

Photo illustration by Mark Jeffries

Photo illustration by Mark Jeffries

Them’s the brakes

Top CEOs saw flat pay growth in 2022, with bonuses down

Total compensation for S&P 500 CEOs nationwide last year marked its smallest year-over-year increase since 2015, with pay increasing 0.9% from 2021.

Here in Virginia, CEOs faced even greater headwinds — their total pay increased just 0.3% from 2021 to 2022, down from a 4.9% increase between 2020 and 2021. The slowdown was a result of reduced equity awards and smaller bonuses, which showed the largest decline of all components of CEO pay, dropping by 6% in Virginia.

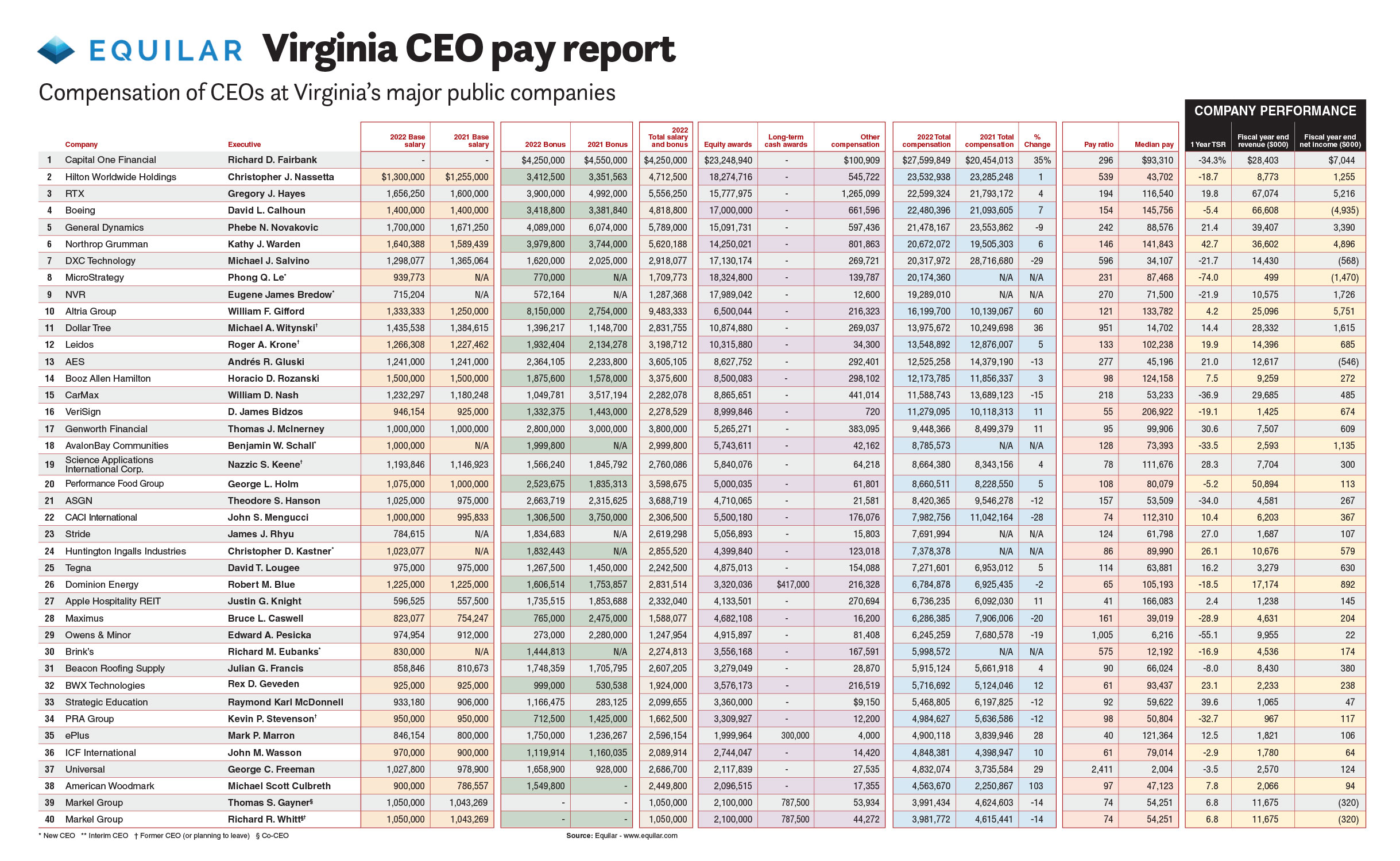

CEO compensation data was gleaned from an annual study conducted by Equilar, a California-based corporate leadership data firm. To determine executive pay, Equilar tallies salary, bonus, perks, stock awards, stock option awards, long-term awards and other compensation. Altogether, Equilar examined CEO compensation data for 52 Virginia-based public companies with annual revenues of $1 billion or more. (See data for the top 40 highest-paid Virginia CEOs of publicly traded companies.)

Virginia’s top-compensated CEO in 2022 was Richard D. Fairbank of McLean-based Capital One Financial. He outearned his peers despite receiving a base salary of $0, an arrangement that has been in place since 1997. His total 2022 compensation totaled $27.6 million, a 35% increase from 2021, when he earned $20.46 million. Like most other Virginia CEOs in the study, Fairbank saw his bonus decrease between 2021 and 2022, in his case from $4.55 million to $4.25 million. The largest increase in his total compensation came from equity awards of $23.25 million — $5 million more than Virginia’s second-highest compensated CEO and up from the $15.82 million he received in 2021.

Fairbank’s boosted equity compensation reflects Capital One’s excellent performance in 2022, when the Fortune 500 credit card giant’s total net revenue increased 13% to $34.3 billion. That was an increase almost twice as large as Capital One saw between 2020 and 2021, when its net revenue increased 7%, from $28.5 billion to $30.4 billion.

Capital One declined comment for this story. Fairbank, who also serves as Capital One’s chairman and president, told investors in April that the company “posted strong top-line growth throughout 2022,” a result of transformations in the bank holding company’s technology and a focus on driving “resilient growth.”

In July, Capital One announced net income of $1.4 billion for the second quarter of 2023, up from $960 million in the year’s first quarter, but trailing the $2 billion in net income it posted in the second quarter of 2022.

Small increases, big paydays

In second place for total compensation among Virginia CEOs of public companies in 2022 was Christopher J. Nassetta, president and CEO of McLean-based Fortune 500 hospitality company Hilton Worldwide Holdings. He received $23.53 million in total compensation, a 1% increase from the $23.29 million he made in 2021. Nassetta was one of the few Virginia CEOs whose bonus compensation rose in that period, bumped up 2% from $3.35 million in 2021 to $3.41 million in 2022. His equity award was also second highest among Virginia CEOs after Fairbank’s, at $18.27 million.

Hilton Worldwide reported $8.77 billion in revenue in 2022, up from $5.79 billion in 2021. The 2021 and 2022 numbers are up from 2020’s pandemic low of $4.31 billion, which represented a massive drop from the $9.45 billion the hotelier pulled in 2019. In August 2020, Nassetta reported that Hilton was averaging around 50% occupancy across all its hotels.

The company is rapidly building back after facing this unprecedented plummet in demand and even being forced to close some properties around the world. It made notable progress in 2022: Hilton opened its 7,000th hotel and hosted almost 2 million guests globally. At the end of 2022, it counted 7,165 properties with 1.13 million rooms, as well as an additional 2,281 properties in its pipeline.

Coming in third place in terms of compensation among Virginia executives is Gregory J. Hayes, chairman and CEO of Arlington-based Fortune 500 multinational aerospace and defense conglomerate RTX, previously Raytheon Technologies until it rebranded in July.

Hayes’ overall compensation was $22.56 million, a 4% increase over his 2021 compensation of $21.79 million. Notably, his bonus sank 22%, from $4.99 million in 2021 to $3.90 million in 2022. RTX brought in revenue of $67.07 billion in 2022, a 4.17% increase from $64.39 billion in 2021. This year, the company announced it was restructuring its businesses, merging four business segments into three: Collins Aerospace, Pratt & Whitney, and Raytheon.

Nationally, leading CEOs’ median pay was $14.8 million in 2022 — a scant 0.9% above 2021, when median pay was $14.5 million. It marked the smallest year-over-year increase since 2015, according to an analysis by Equilar and The Associated Press. The small increase was a major reversal after median pay for top CEOs jumped 17% from 2020 to 2021.

“I think this is mainly because of the market; last year it was not a great market,” says Lei Gao, associate professor for the George Mason University School of Business. “This impacted CEO’s pay because a portion comes from equity.”

Nationally, Sundar Pichai of Silicon Valley-based multinational tech conglomerate Alphabet, parent company of Google, was the highest-paid U.S. CEO identified in the Equilar/AP executive compensation survey. Pichai, who also serves as Google’s CEO, received $225.98 million in 2022. He stands alone among S&P CEOs in earning more than $200 million last year. The only other CEO to earn more than $100 million was Michael Rapino of Beverly Hills-based entertainment company Live Nation Entertainment, who brought home a total of $139.01 million.

While Virginia CEOs are very well- compensated, they make on average less than one-tenth of what these top heavy-hitters rake in.

Equilar Director of Research Courtney Yu notes that because CEO compensation varies by industry, Virginia CEOs are likely to clock in on the lower end of the pay scale.

“About a quarter of the [top-earning] companies in Virginia are in the industrial sector, which is probably due to the region,” he says. “The industrial sector isn’t really a sector that we see on the higher end for compensation.”

Bye-bye, big bonuses

The economic turbulence and attendant uncertainty that characterized 2022 led to some noteworthy changes in CEO pay, especially due to a large drop in bonus pay and reductions in equity awards.

In Virginia’s CEO pay horse race, Gary Bowman of Reston-based Bowman Consulting Group experienced the biggest drop in total compensation, with his pay shooting down 72% year-over-year, from $8.31 million in 2021 to $2.35 million in 2022. His combined bonus and salary went up 4%, so the large drop can be chalked up to a change in equity awards.

The CEO who experienced the biggest boost in compensation was Michael Scott Culbreth of Winchester-based American Woodmark, a kitchen and bath cabinet manufacturer. Culbreth’s total compensation more than doubled between 2021 and 2022, shooting up 103%, from $2.25 million to $4.56 million. The change was due to a 14% bump in salary, and an increase in bonus pay from $1.27 million in 2021 to $1.55 million in 2022.

Bonuses tended to be down across the board in 2022, with only 18 of 52 — or 35% — of top Virginia CEOs seeing their bonus increase instead of decline since 2021. Virginia CEOs’ bonuses fell roughly 6% year-over-year from 2021 to 2022, averaging near $1.8 million in 2021 and closer to $1.6 million in 2022. This overall bonus decline stands in contrast to 2021, when Virginia CEOs’ bonus pay increased on average.

“For this past year, the economy was definitely much more turbulent because of supply chain issues and fears of possible recession, so it was a much tougher year for companies as compared to 2021, when the economy was experiencing a recovery from the pandemic,” says Equilar’s Yu. As a result, he adds, “We did see a drop in bonuses.”

Yu notes that bonuses in 2021 were at “the highest level that we’ve seen in quite some time,” so compensation watchers anticipated a drop. That said, the decline in 2022 was a bigger plummet than the typical up-and-down expected in these numbers, a result that accords with 2022’s inflation and general economic uncertainty.

“Bonuses vary heavily based on economic factors because a lot of the metrics that bonuses are contingent on are short-term, like revenue and things that will be swayed by economic times,” says Yu.

A few Virginia CEOs proved an exception to the rule of reduced bonuses. The Virginia CEO whose bonus grew by the largest amount in 2022 was Raymond Karl McDonnell of Herndon-based education services holding company Strategic Education. His bonus went up 312%, from $283,125 in 2021 to $1.17 million in 2022. Another CEO with a notable increase was Billy Gifford of Henrico County-based Altria Group, the Fortune 500 parent company of tobacco manufacturer Philip Morris USA. Gifford’s bonus jumped 196%, from $2.75 million in 2021 to $8.15 million in 2022.

Pay raise for women CEOs

As in 2021, women heading up publicly traded Fortune 500 Virginia companies in 2022 numbered only three: Phebe Novakovic of Reston-based aerospace and defense contractor General Dynamics; Kathy J. Warden of Falls Church-based aerospace and defense contractor Northrop Grumman; and Nazzic S. Keene of Reston-based federal contractor Science Applications International Corp. (SAIC). They represent a bit over 5% of the CEOs at this level in Virginia.

Novakovic and Warden ranked fourth and fifth respectively for total compensation among all Virginia CEOs. Novakovic’s compensation clocked in at $21.48 million, while Warden posted total compensation of $20.67 million in 2022. Keene ranked 19th on the Virginia CEO pay list in 2022, with her total compensation up 4%, from $8.34 million in 2021 to $8.64 million in 2022. (Keene, who is retiring in October, is being succeeded by former Microsoft executive Toni Townes-Whitley, also formerly president of CGI Federal.)

On a national level, women CEOs’ median pay was greater their male counterparts’ compensation.

“Broadly speaking, we did see an uptick in pay for female CEOs at the median compared to male CEOs,” says Yu. “In our annual CEO study, this is the first time since 2018 that women have made more than men at the median level.”

Growing pay gap

Concerns about the widening wealth gap in the U.S. have shown a spotlight on the ratio between CEO pay and median employee pay in recent years.

At companies included in the Equilar/AP executive compensation study, workers earned a median pay of $77,178 in 2022, a 1.3% increase from $76,160 from 2021. Despite the salary bump, it would still take the median worker a shocking 190 years to earn the amount that an executive making median CEO pay receives in a single year.

In Virginia, the ratio between CEO and employee pay at top companies varied extremely widely. Among companies in the Equilar study, that ratio ranges from 4:1 to 2,411:1, with most companies on the list falling between 50:1 and 300:1.

Freddie Mac (Federal Home Loan Mortgage Corp.) showed the lowest disparity in 2022, as in 2021, with median worker pay of $161,130 coming in at 25.5% of CEO Michael DeVito’s compensation, which totaled $631,385. Richmond-based leaf tobacco supplier Universal Corp. had the highest disparity due to its heavy use of seasonal part-time laborers, many from developing countries, who earned a median of $2,004 in 2022. Universal CEO George Freeman made $4.83 million last year.

Some institutional investors have balked at ever-increasing CEO pay, prompting boards to hold votes on the issue. Some experts believe federal rules on CEO compensation may be in order.

“Regulations might help the market to address some of the ethical questions about pay to CEOs,” says Gao. “One issue that academic and the market industry people hate is when heavy cost comes from regulation. But this one, I don’t think there are many costs associated with it. And since it can provide more transparency to the market, it seems to be something we should do and the market can benefit from.”

The political will for such a move may be lacking, but how much the chasm between CEO and worker pay will widen as the years tick by remains an important and much-discussed question.