Slowly bot surely

Banks, credit unions take cautious approach to AI

Kate Andrews //January 30, 2024//

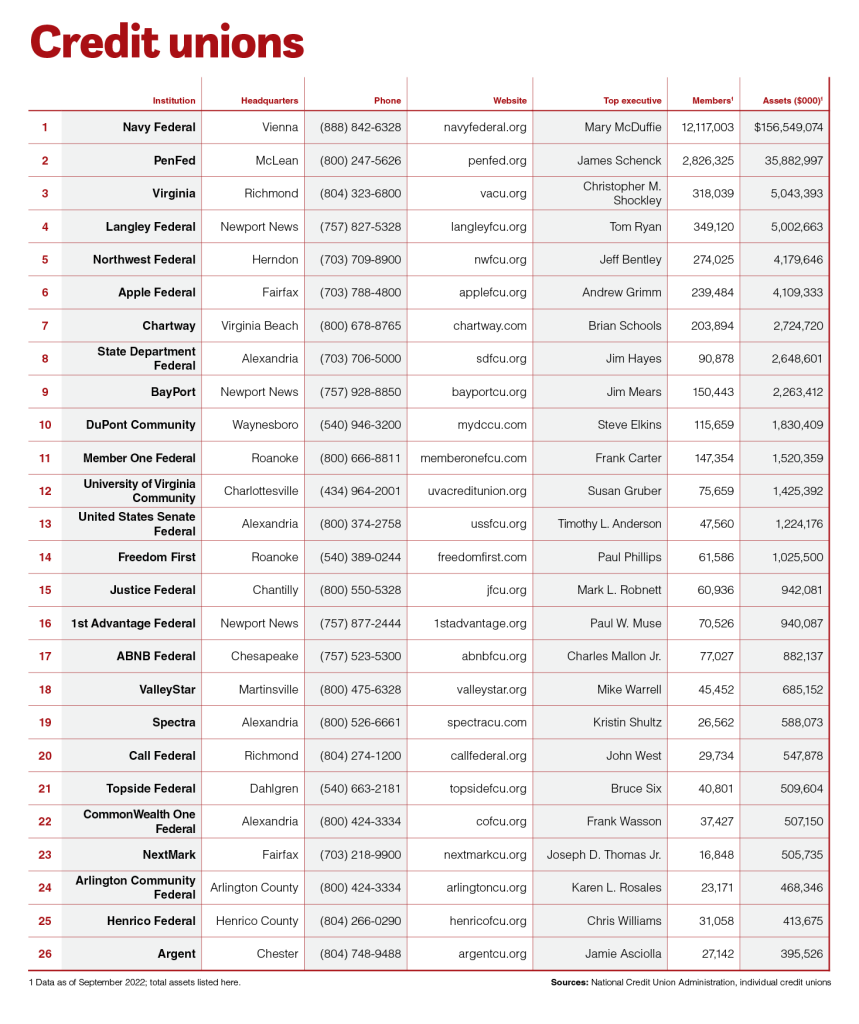

Chartway Federal Credit Union in Virginia Beach is preparing to launch an AI-powered chatbot that will aid customers with transactions, says Rob Keatts, executive vice president and chief strategy officer. Photo by Mark Rhodes

Chartway Federal Credit Union in Virginia Beach is preparing to launch an AI-powered chatbot that will aid customers with transactions, says Rob Keatts, executive vice president and chief strategy officer. Photo by Mark Rhodes

Slowly bot surely

Banks, credit unions take cautious approach to AI

Kate Andrews //January 30, 2024//

From health care to real estate and law, artificial intelligence is becoming an increasingly bigger part of many industries, with executives rolling out new tools and updating policies. Like other businesses, banks and credit unions too have been exploring this electronic frontier, although they’re pairing technological progress with caution.

Even if you’re new to the topic, you probably have heard of ChatGPT, the trailblazing generative AI chatbot launched by OpenAI in November 2022. It was a big deal, gathering more than 100 million monthly users just two months after launch, but ChatGPT is just the tip of the iceberg. Artificial intelligence has been developing in many forms for decades.

When it comes to technology in use or under consideration at financial institutions, most AI tools are focused on behind-the-scenes work.

With the notable exception of Bank of America’s Erica — an AI-powered virtual assistant launched in 2018 that helps customers find banking information via voice and text — financial institutions’ new tools are not personalized but can make customer service faster and more efficient, detect malware reliably and prequalify customers for loans, among other tasks.

While the possibilities for AI seem endless, banks and credit unions have to balance that sense of adventure with the weighty responsibility of keeping their customers’ sensitive financial and personal information secure.

Separating wheat from chaff

Fairfax-based Apple Federal Credit Union, which had more than $4.3 billion in assets and 242,473 members at the end of 2023, is among the top 10 largest credit unions based in Virginia, and it’s also an early AI adopter among credit unions, with several applications currently in place and others in the wings.

John Wyatt, the credit union’s chief information officer, says Apple FCU uses a tool called Zest AI that provides more information on loan seekers than the traditional FICO credit scoring model. It opens doors to borrowers who may have previously had a difficult time getting approved for a loan through no fault of their own.

“We’re looking for … that hidden prime borrower that may not have the credit history that you would need to have a high FICO score,” he says. “What we’re trying to do is qualify more members for loans.”

Another product, CrowdStrike Falcon, helps the credit union examine behavioral indicators to bolster cybersecurity. “It can detect, isolate and respond to threats in real time,” Wyatt explains, as opposed to traditional malware-detection programs, which can take up to three or four months to detect a pattern. By that time, bad actors could have done their damage and moved on to new targets.

Apple FCU is a member of the Curql Collective, a technology capital fund that connects fintech companies creating AI-powered tools with credit unions for investment. In turn, Apple and other members decide which new tools would be appropriate for their organizations. In the past year, with more AI-driven products and entrepreneurs available, Curql (pronounced “circle”) provides a helpful filter for what’s worthwhile and what isn’t, Wyatt says.

“We get first look at vendors that have products that meet the needs of credit unions, and we go to conferences where they actually bring people in to talk about their products. We evaluate them, and we can vote on them and … fund them or not,” he says. “You kind of see what’s coming down the pipeline.”

Wyatt also attended a December 2023 AI innovation conference at which some of the bigger players like Microsoft and Midjourney rolled out new tools and updates. “Things are changing every three, four days,” Wyatt says. “You kind of have to stay ahead of it, and the hype around it is way beyond the peak of inflated expectations.”

In Virginia Beach, Chartway Federal Credit Union has two AI-powered projects underway that are set to go live in March, says Rob Keatts, Chartway’s executive vice president and chief strategy officer. One is Experian’s custom credit score program powered by AI. The other is a customer- facing telephone banking system that will use a “conversational AI bot” that will allow customers to “call in and just check your balance or move money between your own accounts,” Keatts explains. “And for whatever reason, it is extremely popular with people.”

Interestingly, the demographic breakdown of phone banking shows it is most popular among Chartway’s members over age 50 and its youngest members, in their 20s, Keatts notes. Gen Xers and millennials tend to prefer mobile banking, according to statistics pulled by Chartway’s analytics consultants in late 2022.

Last year, Chartway started Chartway Ventures, a credit union-backed venture capital fund to invest in fintech startups, similar to Curql. It helps Keatts learn more about what tools are under development, as well as what is worth investing in — since part of a credit union’s charter is managing its customers’ money responsibly.

“Being a member-owned cooperative credit union, it’s truly our members’ money,” Keatts says. “We really do look to see [if] we’re going to put out x amount for this product, what are we getting back? And then, from a cybersecurity standpoint, everything goes through our standard security checks before we go live. We do a deep dive into the background of the organization we’re partnering with. We don’t put any sensitive information into a public large-language model like a ChatGPT.”

Keatts also learns about new tools and gets recommendations through relationships with other credit unions and attending events where fintech startups present their products.

Both Wyatt and Keatts note that the size of their financial institutions — sitting in the top 10 largest credit unions based in Virginia — allows them to invest in and explore AI tools more easily than smaller credit unions or smaller banks can.

Big banks, bigger investments

On the leading edge of AI use in the finance sector, however, are the nation’s largest banks, among them McLean-based Capital One Financial and Bank of America. Unlike Apple and Chartway, these banking giants build their own tech in-house in addition to collaborating with third parties.

Capital One’s mobile app and fraud detection tools, among other products, use AI and machine learning, and the bank has created a framework to “manage and mitigate risks associated with AI,” its chief scientist and head of enterprise AI, Prem Natarajan, said during congressional testimony in November 2023. “We have a wide range of tools for managing risk relating to AI, including model risk management, credit risk, strategic risk, third-party risk, data management [and] compliance risk.”

Beyond tools in use by the bank, Capital One has invested in broader educational efforts, including its internal Tech College, which provides training to its employees on machine learning-based systems and products.

Meanwhile, as of July 2023 more than 38 million Bank of America customers engaged with virtual assistant Erica to manage their bank accounts through 1.5 billion interactions — making requests like “Replace my credit card,” or “What’s my FICO score?”

In Virginia, 27% of Bank of America clients used Erica as of October 2023, up from 22% a year earlier. In September 2023, using the same proprietary AI and machine- learning capabilities as Erica, Bank of America launched an AI chat function for corporate and commercial clients to manage their finances on its CashPro platform.

Like the credit unions, Bank of America is focused on security of its customers’ sensitive information when developing new products.

“Our approach has never been to … chase the shiny objects,” says Nikki Katz, Bank of America’s Los Angeles-based head of digital. “We’re always looking at it from the perspective of, ‘How does this translate to client benefit?’”

Digital banking is in more demand than ever, as during the pandemic, many banks and credit unions customers moved to online, phone or mobile banking options.

Tom Durkin, global product head of CashPro in Global Transaction Services at Bank of America, says expectations for digital banking “really hit the business community a lot harder, as they had to adapt and leverage some of these capabilities. I think those things factored into expectations … coming off the pandemic, in terms of accessibility to information and the ability to get access.”

Although Bank of America was the first bank to launch a virtual assistant, back in 2018 — an eon ago in technological terms — innovations related to Erica are still going forward even as customer usage increases, Katz notes.

“There’s definitely climbing interest in this space, and we’re continuing to see new applications, whether it’s helping our clients stay on top of their cash flow or changes to their recurring charges,” she says. “As there’s more investment in the space, we’re going to examine opportunities to evolve and improve that client experience and our associate experience with it.”

a