Office sublease supply shrinks in major NOVA markets

Rents are down for all but trophy properties

Josh Janney //June 3, 2025//

AdobeStock

AdobeStock

Office sublease supply shrinks in major NOVA markets

Rents are down for all but trophy properties

Josh Janney //June 3, 2025//

SUMMARY:

- Sublease supply in Northern Virginia‘s major office hubs has declined by nearly 1.5 million square feet since its 2023 peak

- The decline reflects broader state trends

- Companies are now reclaiming previously subleased space or opting for cheaper sublease options

- Sublease rents may rise as supply shrinks

The sublease supply for Northern Virginia’s top office hubs is shrinking as the market has begun to stabilize after the COVID-19 pandemic, according to a May 22 report from Avison Young.

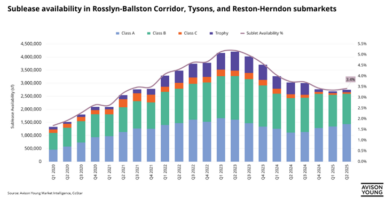

The report shows that sublease availability in the Rosslyn-Ballston corridor, Tysons and Reston–Herndon submarkets rose during the pandemic and reached a peak in the second quarter of 2023, with more than 4.2 million square feet of space available. Since then, however, the sublease supply has dipped by nearly 1.5 million square feet, with 2.69 million square feet available in the first quarter of the year and 2.75 million in the second quarter of this year.

Ryan Price, chief economist with Virginia Realtors, said that Avison Young’s report is similar to what is happening with the broader Northern Virginia market, as well as the entire state.

Citing data from CoStar Group, Price provided information showing that from the third quarter of 2020 to the second quarter of 2022, the state saw year-over-year increases in vacant sublease space from the previous year. The most drastic spike occurred in the second quarter of 2021, when the state experienced a 110.5% increase in available sublease space compared to the prior year. However, Price said that for the past four consecutive quarters, Virginia as a whole has seen a tightening of sublet availability compared to similar data from the previous year.

“As COVID was underway, we did see a big increase in downsizing footprint, downsizing of firms, which leads to an increase in sublease space as there were more people not working in the office,” Price said. “And so a lot of that space was freed up, you know, for sublease tenants. And we’ve seen a bit of a reversal in that regard, as RTO — return to office mandates — become more widespread. I think a lot of firms are looking at their space needs and kind of reclaiming some of that space that they had made available.”

Henry Murphy, an Avison Young market intelligence analyst, said the initial rise in sublease space was tied to financial uncertainty. During the pandemic and afterward, some businesses struggled to afford their current rents.

“You saw a lot of tenants just listing up a lot of their larger space on the sublease market,” Murphy said. “So, you saw the supply of it just continuing and continuing to rise. But then, it kind of started to hit a cap where you started to see some companies have returned to offices.”

He noted that sublease space is offered at a discounted rent and that many companies, trying to shrink their footprint while still wanting to have office space, are opting to move into cheaper, subleased space until they have steadier financials. The pivot for many organizations into using subleased space has absorbed a significant portion of the supply.

On the other hand, he noted that some individuals and organizations have reached a point where, having achieved greater financial stability than they had a few years ago, they are now willing to make more long-term commitments through direct deals with landlords.

“[A direct deal] allows tenants to build out their own space to their own liking, rather than taking somebody else’s space that they had already built out,” Murphy said. “So you get a lot more customization with your own space through a direct deal because the landlord will work with you with a tenant improvement allowance to allow you to build out your own space, to make it your own, rather than just having to move in and deal with what was left with the previous tenants’ build-out.”

Murphy also said some spaces that were sitting on the sublease market that never acquired a tenant “came to term,” meaning that the rental agreement with the original tenant has come and passed. Now, these spaces are being listed as a direct deal through the landlord at a higher rent price than what was previously available when the space was on the sublease market.

Since the supply of sublease space is shrinking, Murphy expects that there will be a little bit more of a demand for it because some tenants will try to take advantage of what’s left on the market. He said rates for sublease markets have been relatively consistent the past few years, but as the supply shrinks, he anticipates the rents to climb a bit.

Rents down except for trophy properties

Avison Young reports that from the second quarter of 2023 to the second quarter of 2025, the trophy assets category was the only one in the Rosslyn-Ballston corridor, Tysons, and Reston-Herndon submarkets to see an increase in asking rents, driven primarily by a significant reduction in available supply and continued tenant preference for high-quality space.

Avison Young says that Class A spaces experienced a modest decline in rents, primarily due to stable supply levels and landlords adjusting pricing to remain competitive amid selective tenant demand. However, Class B and C properties saw notable rent declines despite reduced supply, which Avison Young attributes to ongoing challenges in leasing lower-tier space that remains less attractive to tenants and has largely remained vacant.

While Murphy said he can’t predict what the market will look like in the next few years, he does believe it is in a more stable place than it was a few years ago. He said the spike in available space from a few years ago showed how “volatile” things were, and the market now has seen a “basis reset.”

“Because even if some of these deals are just kind of expiring because they’ve been vacant and no tenant has taken up this space, it’s at least now coming back to direct deals,” Murphy said. “So it’s at least giving choice to landlords to make a decision. If it still remains vacant, then they can maybe decide to do something different with the building, whether that’s convert to a multifamily or renovate the space to try to make it more appealing to tenants. I think it brings more options and less volatility to the market than in the previous couple of quarters.”

Price said a decline in sublease activity usually points toward an increased demand for office space, but it’s hard to predict whether it is a good sign for the market at this point.

“I think it’s still a little early to tell,” Price said. “But I would say that when you just step back and look at, sort of the overall inventory picture that’s out there, the amount of space, the pipeline has really dried up — the new construction pipeline. So I think the overall inventory is likely tightening because of that. So we have less new space in the market, and so the existing space is getting occupied.”