Carrie Hunt, president and CEO of the Virginia Credit Union League, says that many Virginians live in banking deserts. Photo by Caroline Martin

Carrie Hunt, president and CEO of the Virginia Credit Union League, says that many Virginians live in banking deserts. Photo by Caroline Martin

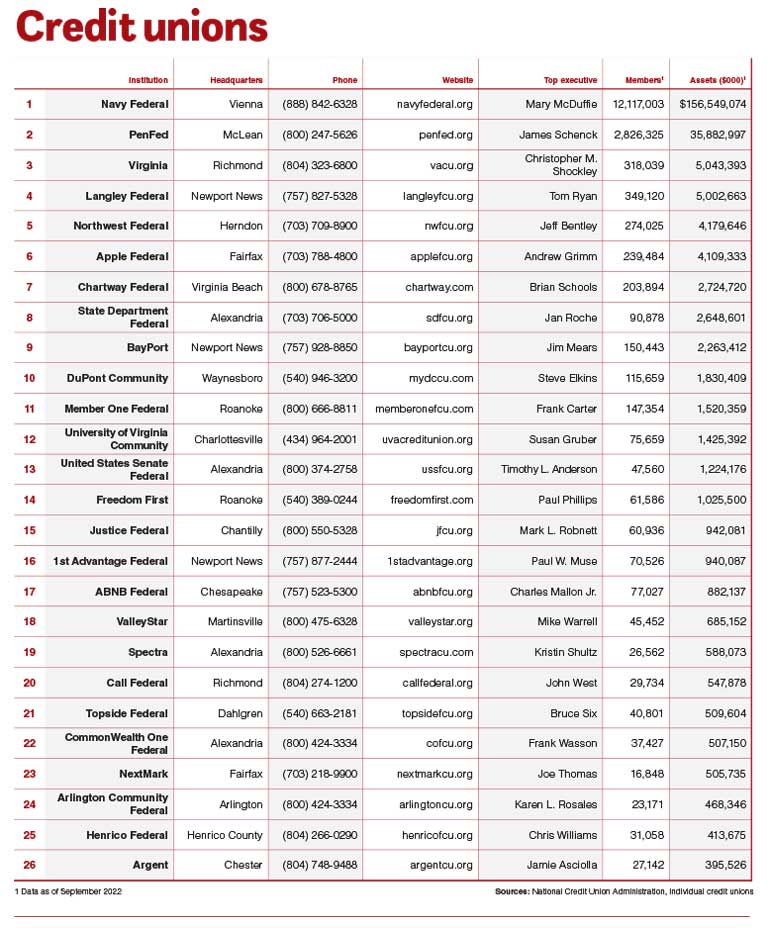

Members only

Credit unions look to legislators for expansion

Kate Andrews //January 30, 2023//

Credit unions in Virginia would like to grow their membership, but a rule change relaxing the state’s policy is not in the cards this spring.

This year’s short General Assembly session — in an election year with a split legislature — makes it harder to pass bills with any controversial elements, and any major expansion of membership at credit unions will bring opposition from community banks. Under state law, credit unions cannot add more than 3,000 members at once without approval from the State Corporation Commission.

“Given the political circumstances, it’s unlikely we will see that this session,” says Carrie Hunt, president and CEO of the Virginia Credit Union League, an advocacy organization for Virginia-based credit unions, both state- and federally chartered.

“We’re still fishing for the federal legislation,” she adds, referring to a bill working its way through the U.S. Senate that would expand credit union fields of membership, or the legal definition of who is eligible to join a particular credit union under its charter. “It hinges on that.”

Meanwhile, Hunt says, “A lot of what we’re doing is … [playing] defense during the [state] legislative session.”

The same could be said, though, for Virginia’s community banks, which won a three-year battle against the credit union industry last August after the SCC ruled that the Virginia Credit Union could not expand its membership to the Medical Society of Virginia, which would have included up to 10,000 people.

The dispute arose in 2019, when the state Bureau of Financial Institutions approved Virginia Credit Union’s request to offer membership to MSV members. The Virginia Bankers Association and seven community banks appealed to the SCC in protest, arguing that the credit union — which at more than 300,000 members and $5 billion-plus in assets is larger than many smaller banks — would have too great an advantage over community banks.

Bruce Whitehurst, president and CEO of the VBA, said in December 2022 that the MSV expansion could have meant up to 40,000 new credit union members, if the 10,000 physicians and their family members all joined Virginia Credit Union — a move he says would have been a threat to banks. “The banking industry is never going to be OK with expansion,” he says, “unless it’s a level playing field.”

But Hunt, who joined VACUL in 2021 after a tenure as executive vice president of government affairs and general counsel for the National Association of Federally-Insured Credit Unions, says that credit unions are “not a competitive threat to banks. Bigger banks are a threat.”

Fixing financial deserts

In June 2022, the U.S. House of Representatives passed the Financial Services Racial Equity, Inclusion, and Economic Justice Act. Sponsored by U.S. Rep. Maxine Waters, D-California, the act is intended to increase access to financial services in underserved communities. An identical bill was introduced in the Senate in September 2022 by U.S. Sen. Alex Padilla, D-California, but was paused in committee. “I am proud to introduce this legislation to allow all federally chartered credit unions to expand their field of membership to underserved areas from the credit union member business lending cap,” Padilla said on the Senate floor.

Supported by the Credit Union National Association, the legislation would allow federally chartered credit unions to add underbanked areas to their fields of membership. It expands the definition of “underserved” to include any area more than 10 miles from a financial institution’s branch office. With banks closing many physical branches in response to the growth of electronic banking, CUNA says that more than 750 census tracts in the U.S. are now “financial deserts.”

“I would love for everyone in the commonwealth to have the opportunity to join a credit union,” Hunt says. “There are many people in banking deserts in the state.”

Also, she says, banking and credit union legislation often have bipartisan support, although in the divided U.S. and Virginia legislatures, “it tends to take longer to debate issues. It’s more an issue of priority-setting.”

Whitehurst agrees: “In Virginia, we’ve enjoyed the ability to work on both sides of the aisle. There tends to be a lot of agreement on economic issues.”

Often, state-chartered credit unions seek the same powers as their federally chartered peers after passage of federal legislation. In the 2022 General Assembly session, Del. Jeion Ward, D-Hampton, sponsored HB 1314, allowing any state-chartered credit union to expand its field of membership to include individuals and organizations in one or more underserved areas. The bill was continued to the 2023 session by the House Commerce and Labor Subcommittee.

Giving no ground

Whitehurst says that banks would only accept a major change in field of membership expansion if state-chartered credit unions are taxed — and in Virginia, credit unions could switch to federal charters to avoid new taxes, he notes. “You’ve got something that’s broken from a policy perspective.” Credit unions do not have to pay federal or state corporate income taxes, while banks in Virginia do, although credit unions are responsible for paying real estate and personal property taxes, the VACUL notes.

That’s the crux of the banks’ argument, that nonprofit credit unions operate under easier rules than community banks do, with a much lower tax burden. “Credit unions are exempt from some regulatory measures,” says Steve Yeakel, president and CEO of the Virginia Association of Community Banks. “We feel like they’re moving away from their original charter.”

Yeakel adds that he sees credit unions gaining enormous financial ground on banks in recent years. In 1934, the Federal Credit Union Act was signed into law by President Franklin D. Roosevelt, authorizing federally chartered credit unions, and state-chartered credit unions were founded before that, including the Virginia Credit Union, chartered in 1928 by a group of state employees. As member-owned, not-for-profit financial cooperatives, credit unions offer similar services as banks, but tout a broader range of loans and savings services at a cheaper cost to members.

Traditionally, credit unions were open only to people with the same employer or residents in the same community or state. However, in the 1980s, federal and state-chartered credit unions began to gain more flexibility in accepting members, leading to larger memberships and assets, while still bypassing corporate income taxes. Today, Yeakel says, some credit unions can undertake major financing deals that many bankers view as a departure from credit unions’ initial missions.

As an example, he points out that McLean-based Pentagon Federal Credit Union, aka PenFed, is partnering with Goldman Sachs Group Inc. on an $847 million private construction loan for The Wharf, a waterfront development in Washington, D.C. Also, in other states, credit unions have purchased community banks, making 13 acquisitions nationwide during 2022.

Despite these disputes, the short General Assembly session — with a divided legislature facing elections this fall — is largely a time to let sleeping dogs lie, Whitehurst says. “In a short session, [legislators] don’t like to see industry vs. industry.”

Crypto and cannabis

If the central question of membership expansion is on hold, that doesn’t mean all banking legislation is. For instance, Hunt’s paying close attention to credit unions’ rights regarding cryptocurrencies.

According to CUNA, “even in a more regulated, consumer-friendly form, digital assets such as stablecoins and retail digital currencies represent an existential threat to credit unions’ deposit funding.”

In essence, cryptocurrencies don’t fall under the governance of the Federal Reserve to authenticate value or regulate transfers, although the Biden administration and members of Congress are taking action to rein in the growing industry.

Following the late 2022 implosion of crypto exchange FTX, in which founder Sam Bankman-Fried was indicted on money laundering charges and federal fraud offenses, U.S. Sen. Elizabeth Warren, D- Massachusetts, and U.S. Sen. Roger Marshall, R-Kansas, filed legislation in December 2022 to close some loopholes in cryptocurrency that create security risks related to international money laundering.

Meanwhile, in Virginia, banks gained the right in July 2022 to provide customers with “virtual currency custody services” — in other words, cryptocurrency assets that exist only on a blockchain — as long as the banks have proper risk-management protocols.

Hunt says one of her goals is to achieve similar state legislation for Virginia-chartered credit unions. According to the National Credit Union Administration, federal credit unions can use distributed ledger technology used to support cryptocurrencies if they stay within federal regulations. A House of Delegates bill permitting credit unions to provide cryptocurrency services passed unanimously in the Committee on Commerce and Energy in mid-January.

Other areas of legislative interest for banks and credit unions include marijuana legislation, both federal and state-level, particularly regarding financial institutions. A major issue for banks and credit unions is the risk of criminal prosecution under federal laws if they allow marijuana businesses to create banking accounts. At the end of 2022, the Senate failed to pass the Secure and Fair Enforcement Banking Act, which would have created a safe harbor for such transactions. The bill has bipartisan support and proponents are hopeful it will pass in 2023.

In 2023, Virginia’s General Assembly is expected to take up some medical marijuana legislation, although full regulation of

retail marijuana sales is likely to be put on pause until 2024, lawmakers have said. A bill filed by Republican Del. Keith Hodges would permit the Virginia Cannabis Control Authority to issue marijuana retail licenses in July 2024, and in July 2023, some pharmaceutical and industrial hemp processors would be allowed to sell cannabis products to adults age 21 or older. A second House bill would allow the authority to issue marijuana licenses as soon as Jan. 1, 2024, but no sales could occur before Jan. 1, 2025.

Cybersecurity and private deposits are also important matters for credit unions, notes Brian Schools, president and CEO of Virginia Beach-based Chartway Federal Credit Union, a federally chartered institution that’s also a VACUL member. In December 2022, VACUL members met with Gov. Glenn Youngkin to discuss an array of subjects, including membership growth, cryptocurrency and the possibility of allowing state-chartered credit unions to accept municipal deposits. It’s a VACUL priority to authorize state credit unions to hold public deposits, just like federal credit unions and banks already can.

Hunt says that credit card fraud costs are also a significant issue for credit unions, which pay part of the fees to customers who were victims of fraud, along with the card companies, but fraud impacts all financial institutions.

According to a September 2022 study by fraud prevention software company Featurespace and payments news site PYMNTS, 62% of all financial institutions reported an increase in fraudulent transactions in 2021 and 2022, but smaller banks and credit unions — holding between $5 billion and $25 billion in assets — suffered the most, incurring higher costs per incident. About 66% of smaller institutions reported such transactions.

As for banks, “we are tracking what may or may not happen with corporate income tax,” Whitehurst says. In December 2022, Youngkin proposed a corporate tax cut from 6% to 5%, as well as a 10% income tax deduction for small businesses.