Looking elsewhere

SHOP marketplace isn’t attracting much interest in Virginia

Tim Loughran //January 29, 2014//

Looking elsewhere

SHOP marketplace isn’t attracting much interest in Virginia

Tim Loughran //January 29, 2014//

For a variety of reasons, most small employers in Virginia appear to be waiting until next year to take advantage of the Small Business Health Options Program, or SHOP, a tool the Obama administration designed to help companies with fewer than 50 full-time-equivalent employees buy more affordable health insurance.

Under the Affordable Care Act, these companies are not required to offer health insurance to their workers. The SHOP program was intended to lower the costs for small employers who want to do so anyway.

Beginning in 2016, according to a posting on the www.healthcare.gov website, the SHOP marketplace will be open to companies with 100 or fewer full-time employees (FTEs).

This year, however, smaller employers are looking elsewhere for affordable insurance as a result of a combination of factors. They include a delay in SHOP’s online enrollment capabilities (until November), the program’s eligibility restrictions, limited tax benefits, a small number of coverage options and bad publicity surrounding the troubled rollout of the ACA’s individual mandate.

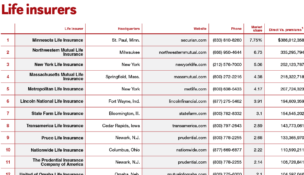

“We haven’t seen a lot of use so far of the SHOP plan,” says Bobby Pearson, spokesman for Optima Health in Virginia Beach, one of a handful of insurers authorized by the U.S. Department of Health and Human Services to offer SHOP coverage in Virginia.

At press time, other authorized SHOP carriers in the commonwealth included Anthem Blue Cross Blue Shield, Kaiser Foundation Mid-Atlantic, Carefirst Blue Choice Inc. and Group Hospitalization and Medical Services Inc.

Pearson says Optima offers small employers seven health plans in its SHOP program and 65 outside it. He says federal regulations require any company wanting a SHOP health plan to cover 70 percent of its FTEs, be limited to one carrier and have one plan for all employees in the insured group.

Next year, SHOP marketplaces in every state are scheduled to widen their offerings more broadly with an easy-to-use online price/option comparison tool similar to the ones offered now by insurance companies around the country.

The plan is to offer small employers and their workers a comprehensive menu of plans with many options at multiple price points from which employees can pick and choose freely.

Speaking of Optima’s limited SHOP menu and others now offered in Virginia, Bill Monday, a vice president with Experient Health, a unit of the Virginia Farm Bureau, says, “There’s just a lot more to choose from off [the SHOP] exchange.”

He says some smaller employers and their brokers have shied away from the program for a number of reasons. “There’s a limited number of insurance carriers, a limited choice of products … the site’s not very user-friendly … so, most companies are not really fooling with it right now … It’s very much a wait-and-see attitude.”

He says small employers might not have explored all their options under SHOP because many decided to protect themselves against an uncertain future under the Affordable Care Act.

“It was a very busy summer and fall for everyone,” he says. “A lot of carriers offered attractive early renewals for their existing customers, effectively positioning themselves ahead of whatever would happen during this first full year of the new health-care law … A fairly large number of employers did that.”

The model for SHOP, say insurance industry executives, is the Federal Employees Health Benefits Program (FEHB), run by the Office of Personnel Management. To federal employees living in Virginia, the FEHB website offers more than two dozen state-specific and nationwide plans.

Health insurance executives say a small company might consider using the SHOP exchange this year if it qualifies for the Small Business Healthcare Tax Credit, first offered to small companies in 2010.

Under the Affordable Care Act, any company that wants to claim the tax credit must be enrolled in a SHOP plan. Starting this year the credit can rise to as high as 50 percent of a company’s health-care premium contributions, up from 35 percent between 2010 and 2013.

But qualifying for the health-care tax credit is difficult. According to federal officials, including the Internal Revenue Service, companies must meet three important criteria to be eligible.

First, companies must have fewer than 25 FTEs, which includes the combined weekly hours of all part-time employees, paid interns, freelancers and other subcontractors.

Second, employees in that company must earn on average less than $50,000 a year. Third, the company must pay at least 50 percent of those employees’ health-care premiums.

Additionally, the full 50 percent tax credit is available only to employers with 10 or fewer FTEs earning a maximum average of $25,000. According to www.healthcare.gov, “the smaller the business, the bigger the credit.” (Tax-exempt employers at nonprofit organizations can see a maximum credit of 35 percent.)

As the IRS says on its website, “So if you have more than 10 FTEs or if the average wage is more than $25,000 (as adjusted for inflation beginning in 2014), the amount of the credit you receive will be less.”

If a company does qualify, IRS.gov says, “Even if you are a small business employer who did not owe tax during the year, you can carry the credit back or forward to other tax years. Also, since the amount of the health insurance premium payments is more than the total credit, eligible small businesses can still claim a business expense deduction for the premiums in excess of the credit. That’s both a credit and a deduction for employee premium payments.

“There is good news for small tax-exempt employers, too,” says the IRS. “The credit is refundable, so even if you have no taxable income, you may be eligible to receive the credit as a refund so long as it does not exceed your income tax withholding and Medicare tax liability.”