Wall Street indexes end lower as Middle East conflict fans inflation fears

Wall Street indexes closed lower as the Middle East conflict escalates, raising concerns over inflation and energy prices amid volatile oil markets.

Wall Street ends narrowly mixed, trading volatile after air strikes on Iran

U.S. stocks closed mixed after volatile trading triggered by U.S. and Israeli air strikes on Iran, with investors buying dips amid market uncertainty.

Virginians spend $688M in January sports wagers

Virginians bet about $687.95 million on sports in January, winning more than $608.4 million, according to Virginia Lottery data.

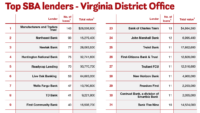

Virginia banks saw big mergers and acquisitions in 2025

Virginia community banks experienced significant mergers and acquisitions in 2025, including Atlantic Union Bankshares' $1.3 billion purchase of Sandy Spring Bank.

Stocks fall as investors mull AI disruptions, oil prices rise

NEW YORK, Feb 27 (Reuters) – Global stocks edged lower on Friday, weighed down by persistent concerns about high valuations and the disruptive force of AI, while the potential for oil supply disruptions due to tensions between the U.S. and Iran lifted crude prices. Market sentiment has weakened as investors worry about the[...]

US stocks fall as Nvidia earnings temper AI sector enthusiasm

U.S. stocks declined after Nvidia's earnings failed to meet investor expectations, cooling enthusiasm for AI-driven tech shares despite strong results.

Wall Street extends tech-powered rally as AI worries abate; Nvidia reports

Wall Street's tech rally continued as Nvidia reported strong Q4 revenue, easing AI disruption concerns and boosting semiconductor stocks.