A surprising coalition of strange political bedfellows has united behind deregulating Virginia’s power utilities and opening the energy market to competition.

But there’s just one hitch: Virginia tried deregulation 20 years ago and it didn’t work, says the commonwealth’s largest electric provider, Dominion Energy.

Katharine Bond, Dominion’s senior director for public policy, describes deregulation as an abject failure not only in Virginia but also in other states. Dominion customers, she says, already “enjoy low, stable prices from energy generated by a rapidly growing portfolio of renewable energy.”

In May, a group of nine politically and ideologically divergent organizations — ranging from highly conservative to very liberal — announced their formation of the Virginia Energy Reform Coalition (VERC). They intend to lobby the General Assembly to end the monopoly on Virginia electrical production held by Dominion and Appalachian Power. Instead, VERC wants to give residential and commercial energy customers a choice of electrical providers, which the coalition contends would result in lower rates.

Dominion and Appalachian, however, say that contention isn’t supported by the facts in other states where customers have encountered higher rates and undependable power service after deregulation.

Opposites attract

VERC’s May news conference saw Ken Cuccinelli, a conservative former Virginia attorney general, joined by representatives of liberal groups such as Appalachian Voices and the Virginia Poverty Law Center.

“In this day and age, when there seem to be more and tougher obstacles to working across party and ideological lines, I’m proud to stand here today with a politically eclectic group that is committed to modernizing Virginia’s electricity markets,” Cuccinelli said, speaking for coalition member FreedomWorks, a Washington, D.C.-based advocacy group. (Cuccinelli has since left FreedomWorks to become acting director of U.S. Citizenship and Immigration Services in the Trump administration.)

On the opposite side of the coalition’s spectrum is Clean Virginia, a nonprofit devoted to reforming Virginia’s state government and energy sector. Toward that end, Clean Virginia endorses legislative candidates based on criteria including whether they accept donations from “regulated monopoly utilities” such as Dominion Energy or Appalachian Power.

Clean Virginia was founded and is funded by Michael Bills, a Charlottesville multimillionaire who is the founder and chief investment officer of Bluestem Asset Management LLC. A political activist, Bills donated more than $820,000 to Virginia Democratic candidates during the past two years — topping Dominion’s $582,313 in political donations to both parties during the same period, according to the Virginia Public Access Project.

The Washington Post has quoted Dominion spokesman David Botkins as calling Clean Virginia “a dark-money, radical-left advocacy organization.” But Brennan Gilmore, the Clean Virginia organization’s executive director, says its “sole interest is the public good.”

How to achieve public good in the electric sector is a question that VERC wants to see legislators consider during the 2020 General Assembly session.

The big ‘if’

Quentin Kidd, dean of the College of Social Sciences at Christopher Newport University, says deregulation could gain traction again in the General Assembly — but that depends on the November election, in which every legislative seat will be on the ballot.

“I could put together a scenario where a deregulation bill could get through a Democratically controlled General Assembly,” Kidd says. Nonetheless, that also would require support from “free-market Republican progressives who might need to craft a market argument,” he adds, providing an apt description of some VERC members.

“The big ‘if’ is what the governor would do,” Kidd says. Gov. Ralph Northam hasn’t signaled any support for deregulation, the political analyst says, and Northam’s critics describe him as a Dominion supporter.

Even if the General Assembly moves toward deregulation, it would be a long process, Kidd says, and “would become an issue for the next governor’s race [in 2021].”

Déjà vu all over again

Virginia’s been here before.

In 1999, the General Assembly voted for deregulation and capped the rates that Dominion could charge customers. The state’s intention was to lower consumer electric bills by introducing competition among retail power resellers.

Largely because Dominion’s rates already were at or below the national average, however, very few real competitors emerged in Virginia, says State Corporation Commission (SCC) spokesman Kenneth J. Schrad.

The SCC’s research showed that customers wouldn’t jump to a different power seller unless rates were 10% to 20% less, he says. And no one could offer a competing rate that low.

“They couldn’t make a margin on it because they couldn’t beat out the incumbent utility’s price,” says Schrad. “I’d be surprised if anybody signed up more than 100 people. We just never saw any robust competitive activity.”

Richard Hirsh, a professor of technology history at Virginia Tech, says that, after deregulation resulted in virtually no competition in Southwest Virginia, folks joked that “you can have Appalachian Power or you can have Duracell. That’s the choice.”

The General Assembly finally ditched deregulation in 2007.

In recent years, Dominion’s critics say, Virginia legislators have allowed the company to have too big a role in crafting energy regulations, largely removing the SCC’s oversight of electric rates and of how much Dominion and Appalachian can reinvest profits and expand.

VERC contends deregulation failed in Virginia because competitors faced a far-from-even playing field.

“Deregulation hasn’t worked where state policies allow monopolies to continue to control the market,” says Travis Kavulla, director of energy for the conservative think-tank R Street Institute, a VERC member based in Washington, D.C.

Dominion, however, argues that in addition to failing in Virginia, deregulation also has been a bust in other states, leading to higher rates and poor service while leaving consumers vulnerable to deceptive and fraudulent “bait-and-switch” tactics by some small energy providers.

Rayhan Daudani, the utility’s media relations manager, points to California, where deregulation brought about “cataclysmic blackouts;” Texas, which had to import some power from Mexico after experiencing rolling blackouts and brownouts; Massachusetts, where households ended up paying “$34 million more per year for electricity from competitive suppliers;” and New York, where “overpayments by low-income customers prompted regulators to prohibit competitive suppliers from selling electricity to those customers.”

In fact, deregulation may have contributed to the massive 2003 Northeast blackout, says Hirsh, the Virginia Tech professor. Overgrown trees hitting power lines were one of several causes of the blackout. Ohio-based FirstEnergy Corp. had cut its maintenance programs to slash costs and remain competitive in its market. Regulated utilities don’t have to worry about that, Hirsh says, because oversight commissions take necessary maintenance into account when calculating rates.

Rates in deregulated states are 37% higher for residential customers and 78% higher for industrial customers, says Appalachian Power spokesman John Shepelwich, citing a recent report from Edison Electric Institute, the trade association for investor-owned electric utilities.

Additionally, state officials in Illinois, Maryland and Massachusetts have warned consumers of predatory practices by some small energy retailers. These companies lured customers with “teaser rates” before raising prices significantly higher than they would have paid staying with the larger state utility.

Pros and cons

Even third-party experts can’t agree on whether deregulation is good for the energy market.

Katie Bays is the co-founder of Washington, D.C.-based Sandhill Strategy, a research and corporate consulting firm that monitors energy issues. In general, she says, well-run deregulation programs have shown themselves to be “very efficient ways to increase competition and lower the cost of delivery.” Competition can also result in creating innovative new service models, she says.

As for customers in some states paying higher prices, Bays adds, those states likely sought to deregulate because rates were higher in their regulated market already.

In general, Bays says, well-run deregulation programs have shown themselves to be “very efficient ways to increase competition and to lower the cost of delivery.”

Paul Griffin disagrees. He is executive director of Reston-based Energy Fairness, a nonprofit, energy-policy advocacy group. “The record is clear,” he says. “Electricity deregulation not only raises electric rates and threatens power supply reliability, but also exposes consumers to deceptive, predatory sales and marketing practices.”

Deregulation, says Virginia Tech’s Hirsh, is attractive to consumers because competition is generally viewed as beneficial, resulting in lower prices and innovation. But with the residential power sector, he says, it hasn’t been terribly successful, evidenced by California, Virginia and several other states repealing, suspending or delaying deregulation efforts.

With Dominion’s power rates still below the national average, Hirsh isn’t sure the outcome of deregulation in Virginia would be any different today than it was in the early 2000s.

Not easy being green

Another VERC issue is increasing renewable energy sources. It’s a big reason that organizations such as the Piedmont Environmental Council, Appalachian Voices, Earth Stewardship Alliance and Clean Virginia joined the coalition.

Dominion says it has shown its commitment to expanding renewables by investing $2.5 billion from 2015 to 2023 and launching nearly a dozen energy-efficiency programs.

During the past four years, the company has increased its number of solar-generation projects from four sites with a total of 5,200 panels to 33 sites with a total of 3.5 million panels.

Collectively these projects have the capacity to generate 884 megawatts or enough power for 221,000 homes — more than the total number of Dominion customers in Virginia Beach.

Dominion also began construction in July on its $1.1 billion offshore wind project off the Virginia Beach coast, the first to be allowed in federal waters. It’s expected to be operational next year.

With the General Assembly’s encouragement, Dominion plans to increase its power generation from wind and solar to 3,000 megawatts by 2022, enough energy to power 750,000 homes, or almost 30% of Dominion’s 2.6 million customer accounts in Virginia.

VERC, however, says that’s not enough. It maintains that insufficient oversight allows Dominion to channel resources into projects that benefit itself and its shareholders rather than its consumers. Critics point to the controversial Atlantic Coast Pipeline as an example. The project currently is halted amid court challenges.

“Our goal is to produce energy where there is a demand,” says Dan Holmes, director of state policy for the Piedmont Environmental Council. “We don’t want to rely on an extension-cord network,” referring to the Virginia utilities’ present system of transmitting electricity via power lines or pipelines from distant generation sources.

Greener power sources also appear more able to gain traction in open-competition markets, VERC members say. In Texas, which deregulated 17 years ago, the use of renewable energy per capita is now higher than in California, says VERC member Adrian Moore, vice president for policy at the libertarian Reason Foundation.

A common purpose

While acknowledging their differences, VERC members say they would rather talk about the common mission that brings them together.

“We live in an America where it is assumed that one cannot have commonality with those who disagree,” says Lynn Taylor, president of the Virginia Institute for Public Policy.

Adds Holmes: “I don’t think political party plays a role in this conversation.”

One thing that unites all the coalition members, however, is their criticism of the influence that Dominion, the commonwealth’s largest corporate political donor, wields over state government.

And although the coalition members maintain that deregulation is not really a political or partisan issue, they know its fate will be decided in the state legislature. And so that’s where they’re putting their focus.

“Right now, we are … talking to folks about what we want to do,” says Moore of the Reason Foundation.

This article has been updated from the version that appeared in the August issue of Virginia Business.

The leadership of LeClairRyan has acknowledged that the 31-year-old firm, once the fifth-largest in Virginia, will be shutting down.

The leadership of LeClairRyan has acknowledged that the 31-year-old firm, once the fifth-largest in Virginia, will be shutting down.

The Capital Region Airport Commission announced Tuesday that it has tapped Perry J. Miller as the new president and CEO of Richmond International Aiport.

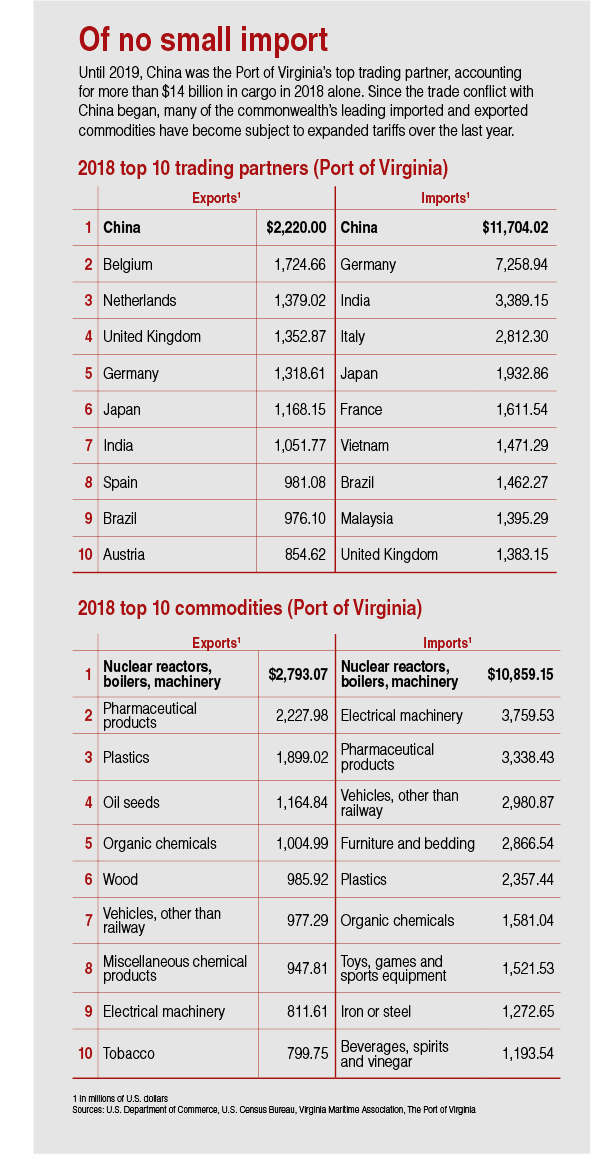

The Capital Region Airport Commission announced Tuesday that it has tapped Perry J. Miller as the new president and CEO of Richmond International Aiport. Chinese tobacco-leaf buyers have migrated to Brazil and Zimbabwe, says Mecklenburg County tobacco farmer Jay Jennings, who is president of the Virginia Tobacco Growers Association. Because of the U.S.-Chinese trade conflict and other factors such as declining tobacco use and competition from electronic vaping devices, tobacco production and prices are down significantly this year, he says, and leaf purchasers are sitting on unsold inventory.

Chinese tobacco-leaf buyers have migrated to Brazil and Zimbabwe, says Mecklenburg County tobacco farmer Jay Jennings, who is president of the Virginia Tobacco Growers Association. Because of the U.S.-Chinese trade conflict and other factors such as declining tobacco use and competition from electronic vaping devices, tobacco production and prices are down significantly this year, he says, and leaf purchasers are sitting on unsold inventory. And going into summer, there was no sign of when the trade conflict would abate or what the long-term impact could be.

And going into summer, there was no sign of when the trade conflict would abate or what the long-term impact could be. Apropos of its high-tech goals, the CCI Northern Virginia node will operate as a “distributed node” or virtual entity, says Deborah Crawford, vice president for research at George Mason University.

Apropos of its high-tech goals, the CCI Northern Virginia node will operate as a “distributed node” or virtual entity, says Deborah Crawford, vice president for research at George Mason University. Remarkably, the recent growth of Cape Charles wasn’t the result of a master plan. The turnaround largely was the result of entrepreneurial restaurateurs and retailers who transformed the town one business at a time, says Town Manager Larry DiRe. “Success breeds success,” he says.

Remarkably, the recent growth of Cape Charles wasn’t the result of a master plan. The turnaround largely was the result of entrepreneurial restaurateurs and retailers who transformed the town one business at a time, says Town Manager Larry DiRe. “Success breeds success,” he says. Last year alone saw 14 retailers set up shop in town (most located along the town’s main street, Mason Avenue) and 116 new business permits (mostly vacation rental homes). Gov. Ralph Northam toured the town last summer, performing a ceremonial ribbon cutting for new retailers and taking in a golf cart parade.

Last year alone saw 14 retailers set up shop in town (most located along the town’s main street, Mason Avenue) and 116 new business permits (mostly vacation rental homes). Gov. Ralph Northam toured the town last summer, performing a ceremonial ribbon cutting for new retailers and taking in a golf cart parade. “The majority of people are happy to see the town booming again,” says Mayor William Smith “Smitty” Dize Jr. Nonetheless, he adds, “I think for me, I’d like to see gradual growth,” though he acknowledges that may be difficult to manage with the genie out of the bottle.

“The majority of people are happy to see the town booming again,” says Mayor William Smith “Smitty” Dize Jr. Nonetheless, he adds, “I think for me, I’d like to see gradual growth,” though he acknowledges that may be difficult to manage with the genie out of the bottle.