New Year’s Day is still more than six months away, but 2017 already is shaping up to be a banner year for Hampton Roads. After years of planning and hurdling obstacles, the region is preparing to open a slew of prominent new and revitalized venues while starting construction on several big-ticket projects.

Construction cranes, in fact, have become a regular fixture on the Hampton Roads skyline. A high-tech luxury hotel is going up in downtown Norfolk, while around the corner the Waterside Festival Marketplace is getting a long-awaited face-lift. Also in Norfolk, construction gets underway in May on a long-awaited, $75 million outlet mall. Meanwhile, Virginia Beach’s oceanfront is witnessing the rebirth of the iconic Cavalier Hotel, and in Newport News, a mixed-use center will house high-tech firms along with retail and luxury apartments. The construction signals a regional revitalization as Hampton Roads continues to work its way out of the 2007-09 recession.

That’s especially true for Norfolk, whose rebirth began downtown and is now spreading to other areas of the city, sparking interest from millennials and entrepreneurs. “We are a very aggressive, forward-looking city,” says Chuck Rigney, the city’s economic development director. “We’re putting together an executable plan and going after it.”

The Main and The Cavalier

Developer Bruce Thompson, CEO of Gold Key/PHR Hotels and Resorts, is making his first foray into his hometown with The Main, a $164 million public-private investment project. Scheduled to open downtown next March, the 300-room hotel bearing the Hilton brand will feature three full-service restaurants. Its major selling point is The Exchange, a 105,000-square-foot conference center that city leaders say will allow Norfolk to attract larger meetings and conventions. “We knew we were missing the tourism market and the ability to host signature conferences that need the setting and experiences that The Exchange can provide,” Rigney says. “It will be the most technologically advanced conference center in the U.S.”

The Main will provide a high-energy eclectic hospitality experience, says Michael Woodhead, Gold Key’s vice president of marketing. A premium seafood restaurant will be on the first floor, while the second floor will feature an Italian eatery along with a piano bar. The Grain, a rooftop bistro overlooking the Elizabeth River, will become a downtown destination, Woodhead adds. “It’s going to pull people from all over Hampton Roads. Between these three restaurants, there’s something for everybody going on in downtown Norfolk. If we weren’t supremely confident that all three will quickly become local favorites, we wouldn’t be doing it.”

While Gold Key brings a contemporary flair to downtown Norfolk with The Main, the company is evoking old-style grandeur on the Virginia Beach oceanfront with the restoration of the 89-year-old Cavalier on the Hill. The hotel will reopen as a five-star member of Marriott’s Autograph Collection in 2017. Its sister property, the Cavalier Oceanfront Hotel, will be replaced by a 300-room Marriott hotel, with the opening targeted for 2018.

Gold Key also is building 82 homes on the grounds of the Cavalier on the Hill. The project is expected to generate $41 million to $52 million in new taxes during its first two decades, while creating 200 year-round jobs and 330 seasonal positions.

Norfolk’s Waterside Festival Marketplace also is undergoing extensive renovations. The Cordish Cos., a Baltimore-based developer, is fronting the nearly $40 million public-private project scheduled to open next spring. “This will bring a new visitor experience onto the riverfront,” Rigney says. “The city leadership wants to create the greatest urban waterside park in the U.S.”

Also downtown, developer Buddy Gadams is converting the 24-story Bank of America office building into 275 luxury apartments, a ground-floor restaurant and a fitness facility. Tagged the Icon at City Walk, the $100 million project will bring 500 additional residents to downtown when it opens next year. “It will be a great address for residents and removes largely vacant office space from our inventory,” Rigney says.

As part of the City Walk project, Gadams is renovating the adjacent vacant office building for Automatic Data Processing (ADP). The New Jersey-based human-resources firm announced in March that it will invest $32.5 million to open a customer-service center in the space, bringing nearly 2,000 jobs downtown. With the influx of ADP jobs, Hampton Roads anticipates annual regional earnings of about $158 million as the overall economic impact climbs to almost $465 million. Nearly half of the ADP jobs are expected to be in place by the end of the year, with the rest filled by mid-2017.

“Together, ADP, the Main, the Waterside District and Icon at City Walk will be a game changer for downtown,” Norfolk Mayor Paul Fraim said in his “State of the City” address in March. “They will dramatically enhance downtown’s vibrancy and help boost and diversify the economy, creating more investment opportunities.”

Outside of downtown

While the downtown district has seen the lion’s share of economic development projects, Norfolk leaders stress that the wealth is being spread around. “We had to fix downtown because, if the apple is rotten at the core, the rest of the apple will die as well,” Rigney says.

He points to Movement Mortgage’s plans to bring more than 800 jobs to the former J.C. Penney building at Military Circle. “There’s a tremendous opportunity to reshape Military Circle. That area can be a significant place for businesses and jobs to locate.”

In addition, Simon Property Group will break ground in May on the $75 million Norfolk Premium Outlets at the former Lake Wright Golf Course. Slated to open next year, the mall is expected to create 800 permanent jobs and generate upward of $3 million in annual tax revenue.

Private employers like ADP, Movement Mortgage and Simon Property Group are expected to enhance the stability of the region’s economy, which has largely depended on Department of Defense spending. That dependence becomes a volatile relationship during times of federal spending cuts.

“The private sector has to start filling in, but it has been slow to do that,” says Vinod Agarwal, director of Old Dominion University’s Economic Forecasting Project. Hampton Roads gained 7,000 jobs last year, reaching a total of 765,383. That number, however, still is below its pre-recession peak of 775,500 jobs.

To be successful, Hampton Roads must start thinking of itself as a regional economy, Agarwal adds. “We can’t think about Norfolk only … or only worrying about Virginia Beach. We depend on each other way too much,” he says.

Virginia Beach arena

Virginia Beach is betting that an 18,000-seat entertainment and sports arena will be a significant generator of new jobs, events and visitors. Developer United States Management is aggressively working to secure financing for the project. “The goal is to have the loan closing in 2016 with construction starting by the end of the year and the grand opening in late 2018,” says Brittany Jeffries, a USM marketing associate.

The Virginia Beach City Council approved the $200 million, privately financed project near the oceanfront late last year, with the city footing the bill for infrastructure improvements. “We see this arena as an iconic symbol for Hampton Roads, not just an amenity for Virginia Beach,” Jeffries adds. “It will not only provide a lot of activities and entertainment opportunities for the city but also attract people from outside the area to experience the region and create jobs and more year-round activities for the region.” The project is expected to generate 2,300 jobs during construction and 440 positions once the arena is in operation.

A sticking point, however, has been the lack of a major athletic team to call the arena home. USM believes that will come in time. “The key to landing a sports team is to have a facility,” Jeffries says, adding that the arena can succeed without a team. “When you have a team, it fills up a lot of the schedule and collects a large portion of revenues. Without a team, you have a lot more prime dates that you can fill with other events.”

Meanwhile, Stephen Ballard, president of S.B. Ballard Construction Co., submitted an unsolicited proposal in March to Old Dominion University for another athletics venue. Ballard wants to demolish ODU’s existing football stadium in Norfolk, Foreman Field, and replace it with a 25,000-seat facility that would open in 2018. The proposal includes five stadium configurations, the most expensive of which would cost $124 million.

Tech Center in Newport News

On the Peninsula, construction continues on the Tech Center Research Park adjacent to the Thomas Jefferson National Accelerator Facility. The project includes 1.1 million square feet of office and lab space, along with a marketplace featuring national retailers making their first foray in the Peninsula, an urgent-care center operated by Children’s Hospital of the Kings Daughters and 284 upscale apartments. W.M. Jordan Co. is developing the $450 million, privately financed project. The mixed-use community emphasizes environment, nutrition and fitness, says John Lawson, W.J. Jordan’s president and CEO. “We want to get people in an environment where they’re collaborating. To do that, we have to provide really interesting retail and entertainment and a great place to live.”

On the Peninsula, construction continues on the Tech Center Research Park adjacent to the Thomas Jefferson National Accelerator Facility. The project includes 1.1 million square feet of office and lab space, along with a marketplace featuring national retailers making their first foray in the Peninsula, an urgent-care center operated by Children’s Hospital of the Kings Daughters and 284 upscale apartments. W.M. Jordan Co. is developing the $450 million, privately financed project. The mixed-use community emphasizes environment, nutrition and fitness, says John Lawson, W.J. Jordan’s president and CEO. “We want to get people in an environment where they’re collaborating. To do that, we have to provide really interesting retail and entertainment and a great place to live.”

A $1 billion ion collider also wouldn’t hurt. The Jefferson Lab is competing with Long Island’s Brookhaven National Laboratory to become the site for the collider, a coup projected to have about a $4 billion economic impact on the region. Lawson believes the tech center would benefit from the collider and its resulting jobs. “This would be a big attraction to people moving here and hired to work for the construction and operation of the ion collider,” he says. The U.S. Department of Energy is expected to announce in the next two years which site will get the collider.

New construction also is underway at several of the region’s medical facilities. Bon Secours Hampton Roads Health System will open a $20 million medical plaza in Suffolk’s Harbour View this fall that will house the Bon Secours Cancer Institute. Meanwhile, Sentara Norfolk General, ranked as a top hospital in Virginia by U.S. News and World Report, is launching a $199 million expansion. The five-year project will add three floors to the hospital, modernize and expand 18 operating rooms and enlarge the emergency department. With the expansion of its Ambulatory Surgery Center, Sentara Leigh Hospital is in the final phase of a massive, eight-year construction project that saw the construction of two five-story patient towers and an employee parking deck.

Overall, as Norfolk’s Rigney says, the projects represent pieces of a larger puzzle designed to invigorate the region with new — and diverse — economic activity.

TCC also serves about 14,000 veterans and active-duty personnel through its Center for Military and Veterans Education, which helps vets transition into private-sector jobs. The college regularly sponsors training programs on military bases, including a recent four-month program that prepared students to become solar energy repair technicians or installers. “We try to anticipate the labor market needs and how to meet those needs,” Baehre-Kolovani says.

TCC also serves about 14,000 veterans and active-duty personnel through its Center for Military and Veterans Education, which helps vets transition into private-sector jobs. The college regularly sponsors training programs on military bases, including a recent four-month program that prepared students to become solar energy repair technicians or installers. “We try to anticipate the labor market needs and how to meet those needs,” Baehre-Kolovani says. Also on tap, the college is looking to renovate its Virginia Beach campus and is building a parking garage on the Chesapeake campus, a first for the city. Construction is expected to begin early next year on a STEM academic building on the Chesapeake campus, which Baehre-Kolovani says is the top community college capital program in the state’s budget.

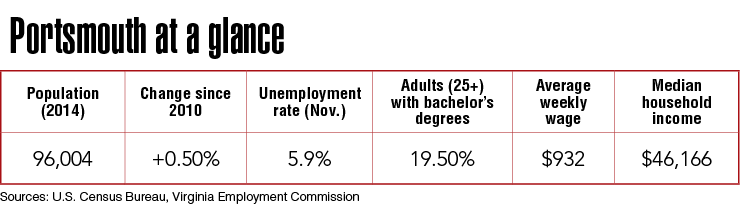

Also on tap, the college is looking to renovate its Virginia Beach campus and is building a parking garage on the Chesapeake campus, a first for the city. Construction is expected to begin early next year on a STEM academic building on the Chesapeake campus, which Baehre-Kolovani says is the top community college capital program in the state’s budget. New City Manager Lydia Pettis Patton is working to shape what she calls The New Portsmouth. “Right off the ground, there are a lot of great things to be done to continue the excitement in the city, improve quality of life and improve education.” she says. “It’s very important that we engage the community and listen to the community.”

New City Manager Lydia Pettis Patton is working to shape what she calls The New Portsmouth. “Right off the ground, there are a lot of great things to be done to continue the excitement in the city, improve quality of life and improve education.” she says. “It’s very important that we engage the community and listen to the community.” In creating a New Portsmouth, Pettis Patton expects city employees to remember that they are public servants. “That’s the only reason we’re here,” she notes. “Citizens need to know what the work of government is, what these departments are for and how we are here to help them.”

In creating a New Portsmouth, Pettis Patton expects city employees to remember that they are public servants. “That’s the only reason we’re here,” she notes. “Citizens need to know what the work of government is, what these departments are for and how we are here to help them.” Elie Bracy III also has faced challenges since becoming superintendent of Portsmouth Public Schools a year ago. The former superintendent of rural Weldon, N.C., schools took the helm of an urban division in which enrollment has declined during the past 20 years to about 14,000 students. Six of the system’s 19 elementary, middle and high schools currently have partial accreditation. The rest are fully accredited.

Elie Bracy III also has faced challenges since becoming superintendent of Portsmouth Public Schools a year ago. The former superintendent of rural Weldon, N.C., schools took the helm of an urban division in which enrollment has declined during the past 20 years to about 14,000 students. Six of the system’s 19 elementary, middle and high schools currently have partial accreditation. The rest are fully accredited. The city’s storied past dates from 1608 when Capt. John Smith surveyed land along a body of water, which he named the Elizabeth River. Today, Portsmouth’s economic development department touts the city’s 90 miles of shoreline, which played a vital role in the nation’s maritime and military history. The Norfolk Naval Shipyard was established in Portsmouth in 1767, while the U.S. Fifth District Coast Guard Command provides maritime protection for the mid-Atlantic U.S. Portsmouth is also home to the U.S. Naval Medical Center, the Navy’s oldest, continuously operating hospital, in use since the 1830s.

The city’s storied past dates from 1608 when Capt. John Smith surveyed land along a body of water, which he named the Elizabeth River. Today, Portsmouth’s economic development department touts the city’s 90 miles of shoreline, which played a vital role in the nation’s maritime and military history. The Norfolk Naval Shipyard was established in Portsmouth in 1767, while the U.S. Fifth District Coast Guard Command provides maritime protection for the mid-Atlantic U.S. Portsmouth is also home to the U.S. Naval Medical Center, the Navy’s oldest, continuously operating hospital, in use since the 1830s.  Now millennials, as well as retirees, are flocking to downtown Portsmouth, says Mallory Butler, the city’s director of economic development. “Millennials want to be part of a vibrant community, and empty nesters want to be away from the responsibility of a yard.”

Now millennials, as well as retirees, are flocking to downtown Portsmouth, says Mallory Butler, the city’s director of economic development. “Millennials want to be part of a vibrant community, and empty nesters want to be away from the responsibility of a yard.” With more than 80 areas of study, CNU focuses on undergraduate education. “We see our role as positioning and preparing students to go off to great graduate programs,” Trible says, adding that the school does offer three, five-year master’s degree programs — in education, environmental sciences, and applied physics and computer sciences. He notes that the overwhelming number of newly minted teachers — who receive bachelor’s and master’s degrees or teaching certification through the program — opt to remain in Hampton Roads.

With more than 80 areas of study, CNU focuses on undergraduate education. “We see our role as positioning and preparing students to go off to great graduate programs,” Trible says, adding that the school does offer three, five-year master’s degree programs — in education, environmental sciences, and applied physics and computer sciences. He notes that the overwhelming number of newly minted teachers — who receive bachelor’s and master’s degrees or teaching certification through the program — opt to remain in Hampton Roads. The Ferguson Center is perhaps the most public sign of the university’s transformation. Designed by renowned architect I.M. Pei, the $70 million facility features a 1,700-seat concert hall and a 500-seat theater. Since opening in 2005, the center has hosted more than 2 million patrons, with more than 70 performances each season, including Broadway plays, symphonies and ballets. “It’s world-class in every respect,” Trible says. “There is nothing like it in Virginia.”

The Ferguson Center is perhaps the most public sign of the university’s transformation. Designed by renowned architect I.M. Pei, the $70 million facility features a 1,700-seat concert hall and a 500-seat theater. Since opening in 2005, the center has hosted more than 2 million patrons, with more than 70 performances each season, including Broadway plays, symphonies and ballets. “It’s world-class in every respect,” Trible says. “There is nothing like it in Virginia.” Forty-five to 60 students enrolled in a class on small and family business and entrepreneurship work with five or six companies each semester. Recent projects have included conducting a food optimization and plate cost study for a local restaurant and completing an inventory analysis for a NASA researcher who developed a test to detect cancer. A faculty member oversees each team, but the students are essentially in charge. “It’s really their show,” Donaldson says. “They’re the professional consultants who decide what hours they work.” Donaldson doesn’t attach a dollar value to the students’ efforts, but he believes firms have benefitted. “We have good anecdotal evidence. Clients rave about the experience they’ve had.”

Forty-five to 60 students enrolled in a class on small and family business and entrepreneurship work with five or six companies each semester. Recent projects have included conducting a food optimization and plate cost study for a local restaurant and completing an inventory analysis for a NASA researcher who developed a test to detect cancer. A faculty member oversees each team, but the students are essentially in charge. “It’s really their show,” Donaldson says. “They’re the professional consultants who decide what hours they work.” Donaldson doesn’t attach a dollar value to the students’ efforts, but he believes firms have benefitted. “We have good anecdotal evidence. Clients rave about the experience they’ve had.”

Thomas Frantz believes expanding the region geographically is the ticket. The chairman of Williams Mullen law firm is a leading proponent of merging the Hampton Roads Metropolitan Statistical Area, the nation’s 37th largest MSA, with Richmond, the 44th largest, to create a mega-region. Combined, the two would jump to 16th, which Frantz says would pique the interest of corporations looking to place plants or regional headquarters in one of the country’s largest metro areas. “The top 25 regions tend to get more advances and looks from companies,” he says. “We would be holding ourselves out to the world as one diverse, strong economic region.”

Thomas Frantz believes expanding the region geographically is the ticket. The chairman of Williams Mullen law firm is a leading proponent of merging the Hampton Roads Metropolitan Statistical Area, the nation’s 37th largest MSA, with Richmond, the 44th largest, to create a mega-region. Combined, the two would jump to 16th, which Frantz says would pique the interest of corporations looking to place plants or regional headquarters in one of the country’s largest metro areas. “The top 25 regions tend to get more advances and looks from companies,” he says. “We would be holding ourselves out to the world as one diverse, strong economic region.”

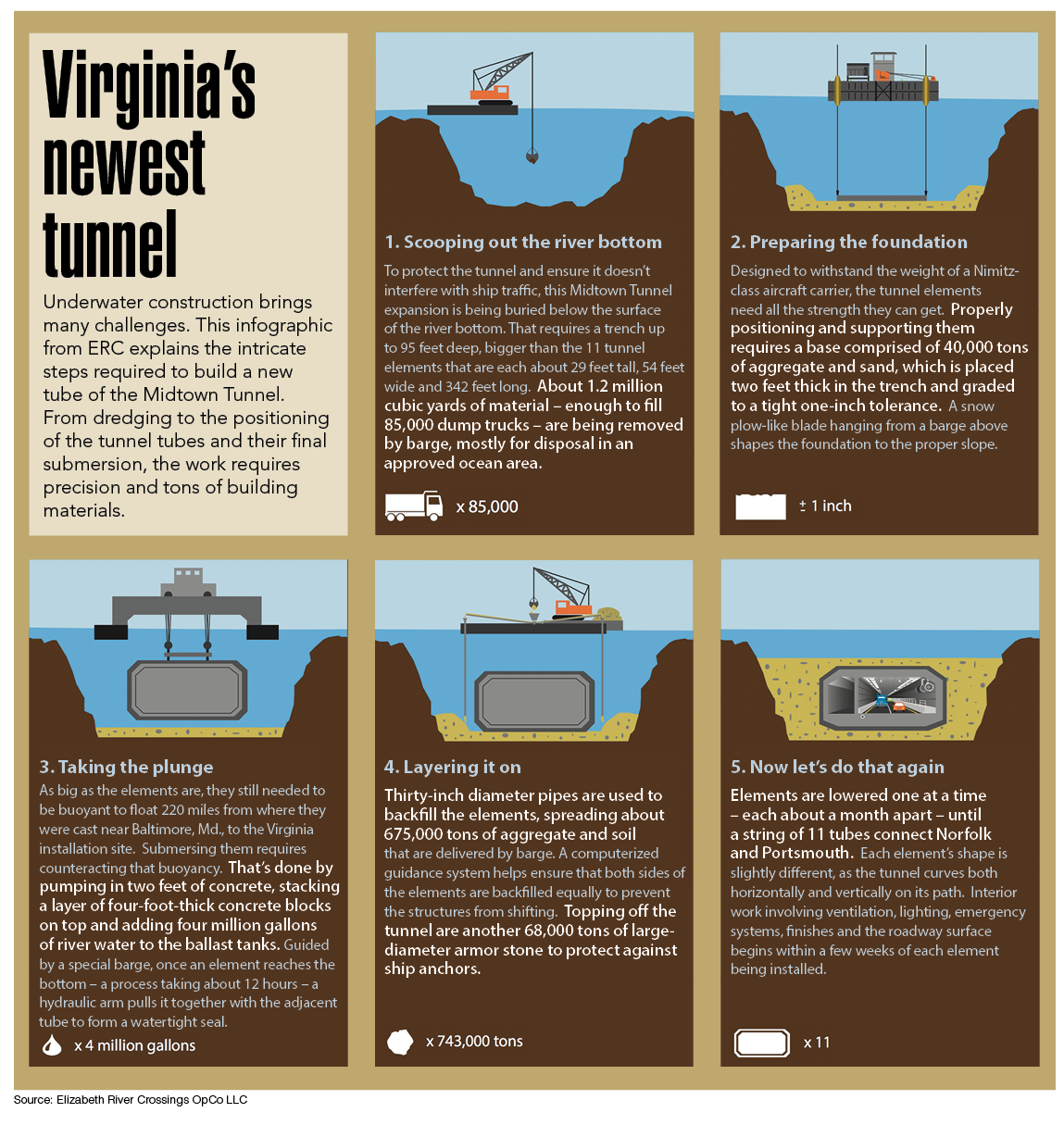

Olde Towne Business Association members in Portsmouth had tried to persuade ERC and VDOT to make one tube bi-directional during the weekend closures. “They said it couldn’t be done, that it was unsafe,” says Tony Goodwin, the association’s president. “But the things were designed to travel two-way traffic per tunnel.”

Olde Towne Business Association members in Portsmouth had tried to persuade ERC and VDOT to make one tube bi-directional during the weekend closures. “They said it couldn’t be done, that it was unsafe,” says Tony Goodwin, the association’s president. “But the things were designed to travel two-way traffic per tunnel.”