A few years ago, Ed Beardsley was looking out the window of his downtown Suffolk restaurant, wondering whether a new business would move into the empty storefront across the street.

Once Suffolk’s main commercial corridor, downtown was facing a downward spiral about five years ago. Despite restaurants like Beardsley’s The Plaid Turnip, a new courthouse being built and other businesses setting up shop, downtown paled in comparison with other areas of the city, especially the bustling Harbour View development in North Suffolk.

“Downtown has always struck me as having a great feel to it, but a lot of people looked at downtown as being neglected,” Beardsley recalls. “They were waiting for [Suffolk] City Council to fix the problems. Then I thought, ‘Why don’t I do something about it?’ It was put up or shut up.”

Beardsley’s resolve led him to create SPARC — Suffolk’s Prime Arts Retail Cultural initiative, which uses art to engage and enhance the community and its economy. Since its founding in 2017, SPARC (not to be confused with the Richmond nonprofit performing arts school with the same acronym) has grown to include about 70 artists who either display their work downtown or have converted vacant properties into studios. Many of them sell their work in the SPARC Shoppe, which Beardsley hopes to combine with One Past 7, an artists’ studio space he opened on the first floor and mezzanine of the former Suffolk Professional Building.

He sees the downtown arts scene as a new start for the venerable city. “A common element of underperforming areas of cities or downtowns that have deteriorated and been revived is public art that revitalizes and helps develop community pride. It all builds in a positive way.”

City leaders are supporting Beardsley’s endeavor. The Suffolk Economic Development Authority awarded the SPARC Shoppe a $15,000 grant to enlarge its space. And in October, City Council is expected to adopt new guidelines for public art displays, which Beardsley says will open the door for the formation of a downtown arts and cultural district. “It’s a huge marketing tool to attract new businesses.”

He believes art, such as painting family-friendly murals on the sides of downtown buildings, will be key to attracting more people downtown. Property owners have offered to host murals, and painting is expected to begin next spring. “This is a huge, inclusive, strong, community-building project,” Beardsley adds. “It definitely will be a conversation starter. It’s very exciting. I think of it as a new start.”

Growing but still small town

To spur economic development and community pride, the Virginia Department of Housing and Community Development designated Suffolk a Virginia Main Street community more than 30 years ago. That led to the rehabilitation of older downtown structures along with new investments, including the transformation of the former Suffolk High School into the Suffolk Cultural Arts Center and the construction of the Hilton Garden Inn and Conference Center.

This time, development is focused on a new, $21.1 million, 45,305-square-foot downtown library to replace the Morgan Memorial Library. It’s expected to open in 2021.

“We welcome the next wave of downtown redevelopment,” says Kevin Hughes, Suffolk’s economic development director. “It’s time to put on a fresh pair of glasses and take a new look at downtown. We have to see how we can best plug in people and attract them and keep them interested in the area.”

“We welcome the next wave of downtown redevelopment,” says Kevin Hughes, Suffolk’s economic development director. “It’s time to put on a fresh pair of glasses and take a new look at downtown. We have to see how we can best plug in people and attract them and keep them interested in the area.”

Although it wants to attract new residents and businesses, the 430-square-mile city also is determined to maintain its small-town, community atmosphere, even as its populace mushrooms. Suffolk is one of Virginia’s fastest growing municipalities, and its population has steadily increased each year since 2012.

With more than 92,500 residents, the city is the only Hampton Roads locality projected to grow by at least 10% each decade between now and 2040. City leaders attribute Suffolk’s growth to its accommodating business environment, high standard of living, many amenities and central Hampton Roads location.

“Suffolk is very diverse,” Hughes says. “We’re very rural to the south and west. We’re able to preserve that because we have so many pockets of opportunity for development within the core city.”

Last year, when Marie DePrado decided to open additional locations of her Virginia Beach businesses, World Class Realty and Pourfavor Coffee, she considered Norfolk and Portsmouth before checking out downtown Suffolk. “I fell in love with the place,” she says. “There’s something special about Suffolk.

Last year, when Marie DePrado decided to open additional locations of her Virginia Beach businesses, World Class Realty and Pourfavor Coffee, she considered Norfolk and Portsmouth before checking out downtown Suffolk. “I fell in love with the place,” she says. “There’s something special about Suffolk.

It’s so traditional, so humble. The people are so nice, and the culture is amazing.”

Since opening her new locations in the 19th-century Luke House last fall, DePrado has become convinced Suffolk’s downtown is on an upswing. “More people are coming to downtown events,” she says. “They’re hungry for more businesses, economic development and community events. The money is staying here.”

Mixed-use mecca

Downtown is one of four significant mixed-use development projects underway in Suffolk. A few miles away, the former Louise Obici Memorial Hospital site sat vacant for more than a decade after the hospital moved to a new facility in 2002. But the construction of Meridian Obici apartments there in 2016 spurred commercial development, culminating with Cinema Café’s plans to build a seven- to eight-screen, 35,000-square-foot movie theater, restaurant and bar at Obici Place. The mixed-use community includes the apartments and an Aldi grocery store. The theater is expected to open in 2022.

Several mixed-use projects also are in the works in the burgeoning North Suffolk area. The Point at Harbour View includes 55 acres of the former Tidewater Community College site, which will be developed into apartments, town homes, condominiums, shops, office space and hotels. TCC sold the property to the Suffolk Economic Development Authority about 15 years ago. The college’s real estate foundation owns the remaining acreage, which it plans to market for development this fall.

Hughes is excited about the site’s prospects. “This one is definitely unique and one we’ve been thinking and dreaming about for a very long time,” the economic development director says. He adds that the location, off Interstate 664, is ideal, with about 80,000 cars driving by it daily. “Development is heading that way.”

Also off I-664, Chesapeake development firm BECO is spearheading Bridgeport as a community-centric development for North Suffolk and the Bridge Road corridor, one of the city’s most heavily traveled highways. Old Dominion University’s E.V. Williams Center for Real Estate named Bridgeport as one of the region’s top five 2019 retail developments.

BECO founders Burt Cutright and Eric Olson envision Bridgeport as a walkable community that will feature more than 700 luxury apartments, boutique shops, offices, an outdoor entertainment venue and a social club. It is slated to be completed within four years.

“The Bridgeport project really aligns with the comprehensive plan we have,” Hughes says. “Folks are interested in walkability and more amenities surrounding where they live.”

Attention-getting

Bridgeport’s first phase will feature 288 one- and two-bedroom apartments in five buildings, with the bottom levels of four of the buildings containing shops, a boutique fitness club, restaurants, a financial firm and an upscale salon. Called 3800 Acqua, the apartments are expected to open this fall.

Bridgeport’s first phase will feature 288 one- and two-bedroom apartments in five buildings, with the bottom levels of four of the buildings containing shops, a boutique fitness club, restaurants, a financial firm and an upscale salon. Called 3800 Acqua, the apartments are expected to open this fall.

The second phase will include the 159-unit apartment complex, Royal Sail at Bridgeport, one of the nation’s first 55-and-older communities in a mixed-use development. “Senior communities are not really common in mixed-use communities,” says Julie Gifford, BECO’s public relations director. The final phase will include building more than 280 apartments in a yet-to-be named complex. BECO has not announced when construction will begin on Royal Sail at Bridgeport, but the project is slated to be completed in four years.

“We’re getting lots of interest,” Gifford adds. “This area is not only the fastest-growing area in Hampton Roads, it’s one of the fastest-growing in Virginia.”

Across Bridge Road from Bridgeport, BECO is constructing the Harbour Breeze Medical Center, which it expects to be completely occupied by the end of the year.

Health care is a growing industry in North Suffolk, with two of the region’s major providers in fierce competition. The Virginia Department of Health approved Bon Secours’ request to build a $77 million, 75,000-square-foot hospital on its Harbour View campus, tentatively scheduled to open in 2021. However, the department denied Sentara’s bid for a 24-bed hospital at its Sentara BelleHarbour facility in North Suffolk, which this year opened a second medical building with an ambulatory surgery center.

Hughes welcomes the new medical offerings to the city’s growing northern corridor. “The winners at the end of the day are our citizens because they will have more specialty care than they’ve ever had before.”

Art projects

And, if Beardsley and SPARC are successful, the city’s arts community will also win, as they envision a Suffolk with more art on display than ever before, with the downtown initiative expanding citywide.

“Downtown is the nexus of the whole thing,” Beardsley says, “but I really believe we can have an arts presence in each borough. I see it stitching together all of Suffolk and becoming a great identifier that shows the power of art and creativity.”

Art also will be a prominent part of Bridgeport, Gifford says, noting that BECO hopes to replicate SPARC’s efforts in downtown Suffolk. “We want to have artwork throughout the property and are in early conversations with SPARC about bringing the arts district out there.”

In addition, Bridgeport will host Suffolk’s first “LOVE” sign. The Virginia Department of Tourism has been celebrating the 50th anniversary of its “Virginia is for Lovers” theme by placing more than 150 of its large LOVEworks signs around the state, with the life-size letters serving as photo backdrops. “People will be able to stand on [it] and get their pictures made,” Gifford says.

There also will be photo opportunities at the three silos BECO plans to refurbish into an artistic, unique bar or restaurant on the former farmland. “Those are going to attract attention from all over,” she says.

Artistic endeavors like these also will help promote community pride, Beardsley adds. “Suffolk should be proud of and celebrate local art and artists. We’re very much promoting the idea that art and artists are celebrating the community and vice versa.”

A $700 million expansion project at the port’s two largest terminals, Virginia International Gateway (VIG) in Portsmouth and Norfolk International Terminals (NIT), will increase the facilities’ annual container throughput capacity by 46% by 2020 and position Virginia as the East Coast’s main container shipping port. VIG’s upgrades include an 800-foot wharf expansion, four 170-foot-tall ship-to-shore cranes (the largest in the Western Hemisphere), 26 additional rail-mounted gantry cranes, four extra inbound gate lanes for trucks, almost 20,000 feet of new rail track and 13 additional container stacks. NIT is getting 60 rail-mounted gantry cranes, 30 semi-automated container stacks and two new Suez-class ship-to-shore cranes. The upgrades and increased capacity have already led to record-setting volumes in fiscal year 2019.

A $700 million expansion project at the port’s two largest terminals, Virginia International Gateway (VIG) in Portsmouth and Norfolk International Terminals (NIT), will increase the facilities’ annual container throughput capacity by 46% by 2020 and position Virginia as the East Coast’s main container shipping port. VIG’s upgrades include an 800-foot wharf expansion, four 170-foot-tall ship-to-shore cranes (the largest in the Western Hemisphere), 26 additional rail-mounted gantry cranes, four extra inbound gate lanes for trucks, almost 20,000 feet of new rail track and 13 additional container stacks. NIT is getting 60 rail-mounted gantry cranes, 30 semi-automated container stacks and two new Suez-class ship-to-shore cranes. The upgrades and increased capacity have already led to record-setting volumes in fiscal year 2019. is investing $60 million to build the 200,000-square-foot cold facility in Portsmouth. Meanwhile, InterChange Cold Storage is building a cold-storage and blast-freezing facility in Mount Crawford, 90 minutes south of the Port of Virginia’s Virginia Inland Port in Front Royal.

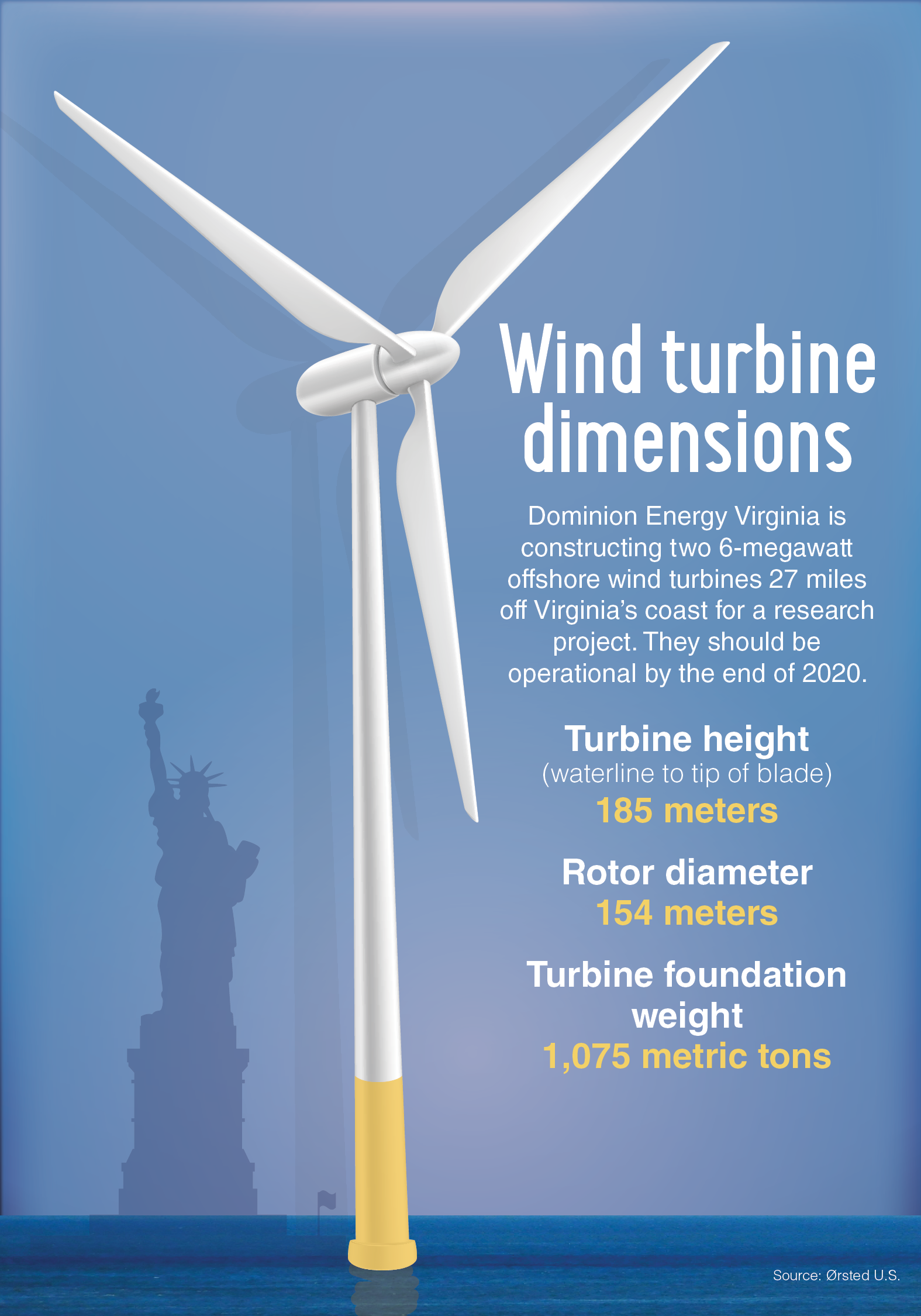

is investing $60 million to build the 200,000-square-foot cold facility in Portsmouth. Meanwhile, InterChange Cold Storage is building a cold-storage and blast-freezing facility in Mount Crawford, 90 minutes south of the Port of Virginia’s Virginia Inland Port in Front Royal. Along with refrigerated cargo, the port is setting its sights on the nascent offshore wind-energy industry. Between 2,000 and 3,000 wind turbines could be installed off the East Coast over the next two decades, and the port is marketing itself as a logistics and staging center for the construction and maintenance of the massive turbines. Dominion Energy is working with Denmark’s Ørsted Energy on a $1.1 billion project to build two 6-megawatt wind turbines about 27 miles off the coast of Virginia Beach. Slated to be up and running next year, the 600-foot-tall turbines are projected to power about 3,000 homes with emissions-free energy. They will be the first to be built in U.S. federal waters and the first to be operated by a regulated utility. (A private energy development group owned by Ørsted operates a five-turbine offshore wind farm in state waters off Rhode Island.)

Along with refrigerated cargo, the port is setting its sights on the nascent offshore wind-energy industry. Between 2,000 and 3,000 wind turbines could be installed off the East Coast over the next two decades, and the port is marketing itself as a logistics and staging center for the construction and maintenance of the massive turbines. Dominion Energy is working with Denmark’s Ørsted Energy on a $1.1 billion project to build two 6-megawatt wind turbines about 27 miles off the coast of Virginia Beach. Slated to be up and running next year, the 600-foot-tall turbines are projected to power about 3,000 homes with emissions-free energy. They will be the first to be built in U.S. federal waters and the first to be operated by a regulated utility. (A private energy development group owned by Ørsted operates a five-turbine offshore wind farm in state waters off Rhode Island.) Portsmouth Marine Terminal would be especially well-suited for housing components because of its 287-acre footprint, says George Hagerman, a senior project scientist in Old Dominion University’s Center for Coastal and Physical Oceanography.

Portsmouth Marine Terminal would be especially well-suited for housing components because of its 287-acre footprint, says George Hagerman, a senior project scientist in Old Dominion University’s Center for Coastal and Physical Oceanography. Another new attraction in the region is the new Ikea store in Norfolk.

Another new attraction in the region is the new Ikea store in Norfolk. Those developments are examples of the increased economic interest in Southeastern Virginia, says Steve Herbert, interim president and CEO of the Hampton Roads Economic Development Alliance, the agency charged with coordinating all business leads coming into the region. “We are actually working on 15 different projects. We’re encouraged by that.”

Those developments are examples of the increased economic interest in Southeastern Virginia, says Steve Herbert, interim president and CEO of the Hampton Roads Economic Development Alliance, the agency charged with coordinating all business leads coming into the region. “We are actually working on 15 different projects. We’re encouraged by that.” A recent decision by Norfolk Southern to move its headquarters to Atlanta in 2021 is far from good news for a region with only two other Fortune 500 companies (Huntington Ingalls Industries and Dollar Tree), but Herbert believes the railroad company’s departure represents an opportunity. “We are short on that kind of office space,” he says, referring to Norfolk Southern’s 22-story office tower in downtown Norfolk. “To have that building in the middle of a prosperous, bustling downtown is a huge asset for us. Nobody is happy about losing Norfolk Southern, but we will aggressively work to market that building.”

A recent decision by Norfolk Southern to move its headquarters to Atlanta in 2021 is far from good news for a region with only two other Fortune 500 companies (Huntington Ingalls Industries and Dollar Tree), but Herbert believes the railroad company’s departure represents an opportunity. “We are short on that kind of office space,” he says, referring to Norfolk Southern’s 22-story office tower in downtown Norfolk. “To have that building in the middle of a prosperous, bustling downtown is a huge asset for us. Nobody is happy about losing Norfolk Southern, but we will aggressively work to market that building.” But U.S. projects currently rely on a European supply chain to produce and deliver wind farm components. The components are massive. The 5-megawatt wind turbines at the Block Island Wind Farm are 180 meters tall, or twice the height of the Statue of Liberty.

But U.S. projects currently rely on a European supply chain to produce and deliver wind farm components. The components are massive. The 5-megawatt wind turbines at the Block Island Wind Farm are 180 meters tall, or twice the height of the Statue of Liberty. Nontraditional students have long found a niche at ODU, which currently has more than 8,100 transfer students. Many come from two-year schools such as Tidewater Community College and Thomas Nelson Community College, which send more students to ODU than to any other Virginia school. Old Dominion has more than 200 program pathway agreements with Virginia community colleges — the most in the state — ensuring students can seamlessly transfer credits. “Historically, Old Dominion University has been a place for degree completion,” Dane notes. “It’s just been part of our history to support nontraditional students.”

Nontraditional students have long found a niche at ODU, which currently has more than 8,100 transfer students. Many come from two-year schools such as Tidewater Community College and Thomas Nelson Community College, which send more students to ODU than to any other Virginia school. Old Dominion has more than 200 program pathway agreements with Virginia community colleges — the most in the state — ensuring students can seamlessly transfer credits. “Historically, Old Dominion University has been a place for degree completion,” Dane notes. “It’s just been part of our history to support nontraditional students.” “It’s important for academic institutions like Old Dominion University to be part of the future of health-related programs in Virginia Beach to interact with those organizations,” says Karen Karlowicz, chair of the nursing school.

“It’s important for academic institutions like Old Dominion University to be part of the future of health-related programs in Virginia Beach to interact with those organizations,” says Karen Karlowicz, chair of the nursing school. The 408-year-old city, however, takes redevelopment efforts seriously. Several neighborhoods are in the midst of revitalization, while makeovers are on tap for others. “This is an old city,” notes Hampton Mayor Donnie Tuck. “It’s 98 percent built out. You really have to have redevelopment.”

The 408-year-old city, however, takes redevelopment efforts seriously. Several neighborhoods are in the midst of revitalization, while makeovers are on tap for others. “This is an old city,” notes Hampton Mayor Donnie Tuck. “It’s 98 percent built out. You really have to have redevelopment.” That history sets Hampton apart from other cities, adds Steven Lynch, the city’s interim economic development director. “Not many places can sustain themselves this long and prosper and grow.”

That history sets Hampton apart from other cities, adds Steven Lynch, the city’s interim economic development director. “Not many places can sustain themselves this long and prosper and grow.” Meanwhile the Whitmore Co. is developing the 162-unit Monroe Gates Apartments in Phoebus, a Hampton neighborhood battered by the Great Recession and the 2011 decommissioning of nearby Fort Monroe as a military installation. Monroe Gates will be built on a 5-acre site that previously housed a manufacturing facility, with completion targeted for spring 2020.

Meanwhile the Whitmore Co. is developing the 162-unit Monroe Gates Apartments in Phoebus, a Hampton neighborhood battered by the Great Recession and the 2011 decommissioning of nearby Fort Monroe as a military installation. Monroe Gates will be built on a 5-acre site that previously housed a manufacturing facility, with completion targeted for spring 2020. Many of those jobs would be based in the new VABeachBio Innovation Park. The 155-acre site is near health-care, biomedical and educational facilities, including Sentara Princess Anne Hospital, LifeNet Health, Operation Smile, the Virginia Beach Advanced Technology Center, the Virginia Beach campus of Tidewater Community College and the Virginia Beach Higher Education Center, which provides on-site classes through Old Dominion and Norfolk State universities.

Many of those jobs would be based in the new VABeachBio Innovation Park. The 155-acre site is near health-care, biomedical and educational facilities, including Sentara Princess Anne Hospital, LifeNet Health, Operation Smile, the Virginia Beach Advanced Technology Center, the Virginia Beach campus of Tidewater Community College and the Virginia Beach Higher Education Center, which provides on-site classes through Old Dominion and Norfolk State universities.  With the growing biotech presence in the city, the timing is right to boost ODU’s health-science offerings, says Austin Agho, the university’s provost and vice president for academic affairs. “On average we receive 300-plus applications a year for the nursing school, but we can only admit 60 to 65 students. With the expansion, we will be able to increase the class size to 80.”

With the growing biotech presence in the city, the timing is right to boost ODU’s health-science offerings, says Austin Agho, the university’s provost and vice president for academic affairs. “On average we receive 300-plus applications a year for the nursing school, but we can only admit 60 to 65 students. With the expansion, we will be able to increase the class size to 80.” “It should be Norfolk,” says Deborah K. Stearns, senior vice president of JLL, a global real estate services firm. “We need an identity that people can find on a map. Coastal Virginia is a great tourism label, but it’s not on a map, and it doesn’t say business.”

“It should be Norfolk,” says Deborah K. Stearns, senior vice president of JLL, a global real estate services firm. “We need an identity that people can find on a map. Coastal Virginia is a great tourism label, but it’s not on a map, and it doesn’t say business.” Many, if not most, Hampton Roads residents live in one locality, work in another and shop or dine in yet another, often all on the same day. Traveling throughout the region’s network of highways, bridges and tunnels long has been a source of frustration. As multiple infrastructure projects come on line, however, the ability to get around is steadily improving. “We are building more transportation projects in the next six years than we have in three decades,” says Robert Crum, executive director of the Hampton Roads Transportation Planning Organization.

Many, if not most, Hampton Roads residents live in one locality, work in another and shop or dine in yet another, often all on the same day. Traveling throughout the region’s network of highways, bridges and tunnels long has been a source of frustration. As multiple infrastructure projects come on line, however, the ability to get around is steadily improving. “We are building more transportation projects in the next six years than we have in three decades,” says Robert Crum, executive director of the Hampton Roads Transportation Planning Organization.