Pandemic housing market has fewer sellers, higher sales prices

Long & Foster Real Estate President Larry "Boomer" Foster shares most recent market insights

Sydney Lake //April 24, 2020//

Pandemic housing market has fewer sellers, higher sales prices

Long & Foster Real Estate President Larry "Boomer" Foster shares most recent market insights

Sydney Lake //April 24, 2020//

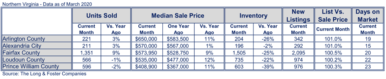

Virginia Business virtually sat down with Larry “Boomer” Foster, president of Long & Foster Real Estate, to get the current pulse on the real estate market in Virginia. The most recent data published was reflective of March real estate transactions in Northern Virginia, but Foster shared insight from the most up-to-date real estate data available from the past two weeks in April. The data includes all residential real estate transactions in Long & Foster’s footprint, and is inclusive of all transactions.

Virginia Business: How has the housing market changed during the pandemic?

Foster: I would suggest that not just in Northern Virginia, but certainly in our entire footprint [which stretches from Central Virginia to New Jersey], that the impact of the coronavirus has certainly been significant, but the most recent trends show that people are really coming back into the market. In Northern Virginia, new listing inventory is down about 35%. But if you go back over the last four years, the trend with inventory decreasing has been significant as well. We think double-digit decreases almost monthly for 48 months in a row.

VB: Are houses still going on the market?

Foster: Certainly less are going on the market. There’s a number of homeowners that are taking a pause from being on the market. The number of homes off the market has gone up over the past three or four weeks. But what’s interesting is that there are huge opportunities out there right now for people who are going on the market. Demand way outpaced supply in Northern Virginia for a very long time because supply was so depleted and credit was so available and people were out looking. A large number of buyers got shut out of the marketplace because other stronger buyers were winning competing-offer situations.

VB: How have buyers been affected?

Foster: There’s still plenty of buyers. What was a seller’s market at most price points has turned into a more balanced market during this. If you look at what’s happening with average prices in Northern Virginia for April — if you compare April of 2020 to April of 2019 — the average price in Northern Virginia is up 9.2%. Even in the midst of the pandemic, the average price point in Northern Virginia right now is a little over $652,000, whereas at this time last year that was just a little over $597,000.

VB: How have sale prices changed?

Foster: They’re up dramatically. For Alexandria, the average sales price is up about 18%. Arlington County is up almost 8%. Fairfax is up 10%. Loudon County is up almost 9%. When you put all of those together, the average price point [in Northern Virginia] is up 9.2%.

VB: Has the pandemic affected how long houses are on the market?

Foster: At this time last year, on average, it would take 19 days to sell a home in Northern Virginia. Right now it takes 14 days.

It’s counterintuitive to think about the fact that the volume that has sold this year in Northern Virginia compared to last year’s is down 11% of the units, and the number of homes that have sold are down about 18% right now. The only reason the rest of those numbers would look positive is because the amount of demand still exceeds the amount of supply out there. There’s still credit availability, albeit changed and more restrictive than it was before because of the CARES Act. There’s still credit availability for quality qualified buyers and qualified buyers are out still transacting and still buying homes right now.

It’s reflective of supply and demand. [A home is] going to go under contract quicker when you’ve got more people looking at it because there’s going to be a fear of loss. Buyers aren’t going to sit back and take their time to make decisions on homes when they know other buyers are looking for the home that they’re looking at.

What are you anticipating for the future?

Foster: The negativity and volatility that we’re seeing in the economy has caused a challenge with consumer confidence. What we understand with human nature is when there’s a crisis of confidence, people pause. They don’t stop, they just pause, and they wait until they’re more confident. As we projected what was going to happen the rest of this year, [we anticipated] that the hardest hit month was going to be April. You’ll see people gradually come out more in May and more in June. It’ll affect us the rest of this year, and certainly until there’s a vaccine for the virus.

But if you compare what’s happening in the real estate industry with what’s happening in the economy in general, the trends are way more positive in the real estate industry. People are parking money in real estate because they’re worried about volatility on Wall Street and they know that their returns on bond yields are not very good right now.

We dropped off a cliff three weeks ago, four weeks ago, and the trends since then have been very positive. I think what will affect us the most is in the mortgage side of things as the Fed figures out the liquidity challenges the banks are experiencing and the servicing challenges caused by the CARES Act that will free up even more credit to qualified buyers and it’ll reduce some of the qualifications that have become more stringent in recent weeks.

T