A cautious outlook

Virginia CPAs remain wary of economic hurdles

A cautious outlook

Virginia CPAs remain wary of economic hurdles

While business has not returned to its prerecession level, the construction company R.E. Lee Cos. in Charlottesville is growing, and Chris Lee, its CEO, is hiring. Revenue this year is up about 18 percent, and the total workforce has grown almost 30 percent.

But growing even faster for the family-owned company is the cost of health care, which is expected to double next year. “It’s going to go from less than $200,000 to $400,000 in real dollars,” says Lee. “They’re huge numbers.”

The situation, however, could have been worse. The company is paying the full premium on an additional health plan offering fewer benefits and a higher deductible to ensure that all of its 120 employees sign up for coverage. Otherwise, the company might fall prey to new Affordable Health Care rules that, Lee says, would have made the monthly cost per employee 30 percent higher.

Despite its size, Lee’s company is no newcomer to employee health insurance. It has provided coverage for years, paying about 75 percent of the premium. Providing health benefits “is a critical component to attracting and retaining talent,” Lee says.

Health-care costs continue to represent one of the biggest issues Virginia businesses are facing, according to the 2016 Economic Expectations Survey conducted recently by the Virginia Society of Certified Public Accountants.

“The big thing is the rising cost of health insurance,” says L. Michael Gracik Jr., CPA, managing partner at Keiter in Glen Allen. “It’s causing people to spend a lot of time looking at their health coverage, trying to make changes to it, which in making changes to it, they are reducing or eliminating benefits.”

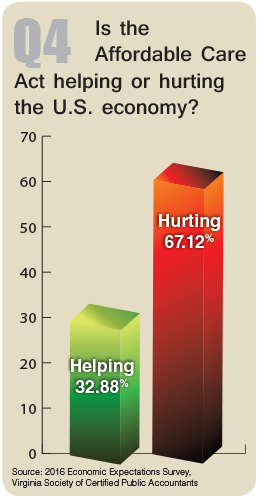

The annual survey, in which more than 300 Virginia CPAs participated, found that a majority of respondents are highly skeptical of the Affordable Care Act, including the expansion of Medicaid coverage. Nonetheless, they dismiss calls for repeal of the law, favoring reform instead.

Virginia CPAs also offered a cautious view on the future course of the economy and blamed partisanship in Washington, D.C., and Richmond for the failure of federal and state governments to address urgent issues.

A slow recovery

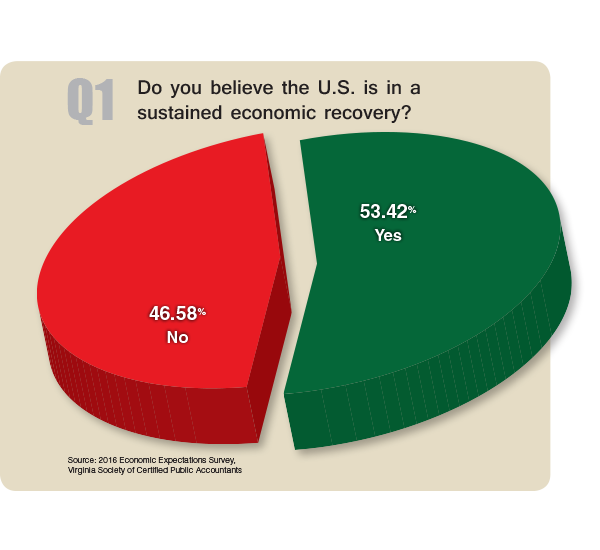

CPAs continue to be cautious in judging the nation’s recovery from the 2007-09 Great Recession. While a majority of respondents (53.4 percent) say the nation has reached a sustained economic recovery, the rest (46.6 percent) don’t think it has.

CPAs also were on the fence about their outlook for the national economy next year. About 30 percent were either somewhat pessimistic or somewhat optimistic about the U.S. economy for next year. Only 7 percent had very pessimistic or very optimistic views about state of the economy. The rest of the respondents had a “balanced” view of the economy, expressing neither optimism nor pessimism.

“This is a strong vote that they’re straddling the middle, ‘The economy is probably OK, but I’m looking over my shoulder,’” Fuller says. “That’s where the rest of the country is … It reflects a cautious population.”

That caution can be seen in recent national figures on consumer confidence. The Conference Board’s consumer confidence index increased moderately in September, but fell in October.

“Consumers were less positive in their assessment of present-day conditions, in particular the job market, and were moderately less optimistic about the short-term outlook. Despite the decline, consumers still rate current conditions favorably, but they do not anticipate the economy strengthening much in the near-term,” Lynn Franco, director of economic indicators at The Conference Board, said in a statement.

When asked about actions their companies, industries or clients are taking in response to economic conditions, CPAs expect things to stay relatively unchanged — in areas ranging from capital spending to compensation and hiring.

Nonetheless, the nation and state should see employment growth next year, says Chris Chmura, an economist who is CEO of Richmond-based Chmura Economics & Analytics. The Bureau of Labor Statistics’ Current Employment Statistics survey found that Virginia employment grew six-tenths of a percentage point in 2014 to 4.03 million jobs. That number is expected to rise 1.1 percent by the end of this year to 4.08 million jobs and rise 1.3 percent next year to 4.1 million jobs.

Nationwide, employment grew 1.9 percent last year to 140 million jobs. That pace is expected to increase slightly to 2 percent this year before falling back to 1.5 percent in 2016.

Although CPAs aren’t overwhelmingly optimistic about the U.S. economy, they appear more positive about the direction of Virginia’s economy next year. More than 45 percent of respondents are “somewhat” or “very” optimistic about the state economy; 32 percent hold a “balanced” view and 21.7 percent are “very” or “somewhat” pessimistic.

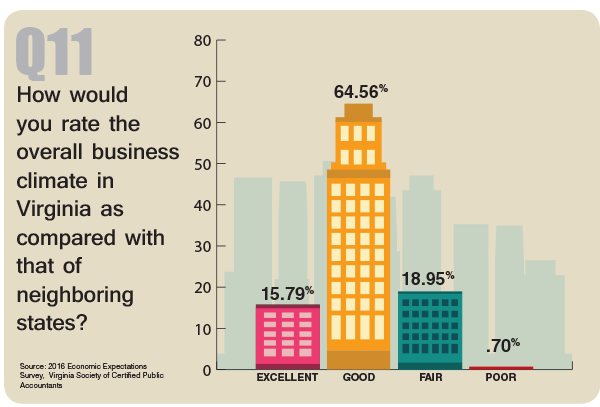

A majority (64.6 percent) also rated the overall business climate in the commonwealth as “good.” Most also have “somewhat” or “very” optimistic outlooks for their companies and industries in 2016 (58.4 percent and 47 percent, respectively). Most respondents (51.2 percent) believe capital investments in the state will remain the same and almost 40 percent think they will increase. Only 8.8 percent say capital investments in Virginia will decrease next year.

The road ahead

While the survey partly paints a positive picture of the commonwealth, it also shines a light on some of Virginia’s biggest problems. A sizeable number of the CPAs (almost 23 percent) say infrastructure is Virginia’s most pressing issue. A majority of Virginians probably associate the commonwealth’s infrastructure woes with the state of its roads. According to the American Society of Civil Engineers’ 2015 Report Card for Virginia’s Infrastructure, the state received a C- on its infrastructure. When looking at specific infrastructure issues, ASCE gave Virginia’s roads and wastewater facilities the poorest grades (D and D+, respectively).

But infrastructure problems don’t always mean tough commutes. “In Southwest Virginia, we don’t have a lot of traffic jams going on, especially in the more rural areas,” says Jennifer Duff, CPA, the chief financial officer at Management Stack in Salem. “But we have airport problems. It’s very difficult to get in and out of Roanoke, and I know that that deters businesses from going there.”

Threats on the horizon

Besides infrastructure, health-care costs, government regulation, education and federal budget cuts also were among the top concerns revealed in the survey. Fuller, the GMU economist, is surprised that federal budget cuts weren’t the chief concern. “I would have thought that would have been the hot-button topic,” he says.

The threat of a government shutdown and sequestration — automatic federal budget cuts — still looms. Earlier this year, Congress passed a temporary budget, which will fund the government until Dec. 11. At that time, Congress has to agree on a long-term budget, which could include another round of sequestration. Congress must also raise the U.S. debt ceiling, the government’s borrowing limit, by Nov. 5, or risk default.

Chmura also is concerned about the impact federal budget cuts will have on Virginia since the commonwealth receives more federal contract money than any other state. According to a recently released report prepared by Chmura Economics & Analytics, Virginia received $54.7 billion in defense spending in fiscal year 2014 (that includes contracts and defense payrolls).

Northern Virginia and Hampton Roads are the areas of the commonwealth that will likely be hit the hardest if another round of sequestration or a government shutdown occurs. According to Chmura’s report, Fairfax County received the most defense dollars in the nation in 2014 ($19.1 billion). Newport News, the home of Newport News Shipbuilding, also was among the top 10 defense spending locations, receiving $6.2 billion.

“Just the uncertainty itself has caused people not to expand, perhaps, as rapidly as they otherwise would. Not to hire as aggressively as they might. Not to take some of the risks that, in the past, weren’t considered as risky, but now they have to choose their steps much more carefully and moderate their risks because of that uncertainty that’s out there,” says Sean O’Connell, CPA, partner and tax service line leader for PBMares in Fairfax.

While CPAs have varying views on the top issues facing the state, they are certain about one thing: the negative effect of partisanship. Almost 80 percent said partisanship at the federal and state level is preventing government from addressing urgent needs that have an impact on business.

OneVirginia2021, has filed a lawsuit asking for Virginia’s legislative boundaries to be redrawn, saying they are not compact and violate the constitution.

An effort to redraw Virginia’s congressional boundaries is underway. Federal courts have ruled that congressional maps, drawn in 2011, illegally crammed black voters into one district to dilute their influence in other districts.

Health-care puzzle

The need for bipartisanship is not the only issue on which many CPAs agree. Most also are on the same page in criticizing the Affordable Care Act. Two-thirds of CPAs (67.1 percent) say the ACA is hurting the U.S. economy, although most (54.8 percent) believe it should be reformed, not repealed. That’s slightly higher than last year when 51.8 percent said the ACA should be reformed.

“I think most people understand and believe that the ACA is here with us to stay in some way, shape or form,” says Jimmy Haggard, CPA, partner at Dixon Hughes Goodman in Newport News. “Given that understanding, I think most people believe that it would be better to go through some modification rather than a repeal.”

There is one part of the ACA, however, that most of the CPAs surveyed believe Virginia should avoid: the expansion of Medicaid. The Republican-controlled Virginia General Assembly has blocked expansion efforts by Democratic Gov. Terry McAuliffe.

Medicaid and Medicare reimbursement shortfalls are among the issues hurting medical providers that need to be addressed by legislators, says Sean Connaughton, president and CEO of the Virginia Hospital & Healthcare Association, which represents the state’s major health-care systems and hospitals. According to the latest data from Virginia Health Information, 31 out of 88 state hospitals had a negative operating margin in 2013. Forty-six percent of the commonwealth’s 37 rural hospitals operated in the red that year.

“Our hope is that we have a much broader discussion about the financial challenges facing Virginia’s hospitals we see right now, that the current system can’t continue the way it is, where all the burdens are being put on the providers and yet we can’t get folks to really talk about these challenges in any sort of concrete way,” he says.

Lee’s dilemma

David Barney, vice president at Scott Insurance in Lynchburg, says many midsize employers will face new challenges in 2016 in complying with the ACA. Starting next year, employers with 50 or more full-time-equivalent workers will have to offer health insurance that complies with ACA standards or pay a penalty.

The small-group market change created a dilemma for Lee, the owner of R.E. Lee Cos. He wants to avoid being lumped into that category. His company has 120 employees, but only 72 enrolled in health insurance last year. That number might mean he would have to participate in the small-group market. To bypass that issue, Lee added a third, less extensive level of insurance coverage to the company’s existing two plans. The company is paying 100 percent of the premium on the new plan to encourage all employees to sign up for health insurance.

The higher costs in the small-group market “would have reduced the number of employees that would use the company plan,” Lee says. Falling participation “would have increased premiums again next year, precipitating a negative spiral,” he adds.

Changes to the small-group market may be on the way. President Barack Obama has signed the Protecting Affordable Coverage for Employers (PACE) Act, which lets states decide what size businesses are considered “small” for health-insurance purposes. According to a statement on the Virginia State Corporation Commission’s website, that decision lies with the Virginia General Assembly.

“In summary, the Bureau [of Insurance] has no authority to administratively preserve the current definition of ‘small employer,’ as this will require a legislative change,” the statement says. “However, some small employer policyholders may be able to keep their current policies for a period of time if they renew their policy on or before October 1, 2016, if their current carrier still offers the policy and agrees to renew it.

Lee would like for the small-group market to be eliminated, but he says the passage of the PACE Act is a step in the right direction.

“With state control, hopefully, we can get some better decisions on our health programs,” he says.

For now, it looks like Lee and many other employers will continue grappling with the ACA puzzle.

“It’s been a mind-numbing few years, and I am pretty sure we’re not done with it yet — trying to figure out how we’re charged, why we pay as much as we do, and what can we do to manage these costs,” he says.

Click here for a copy of the full 2016 VSCPA Economic Expectations Survey Results.

Virginia Society of CPAs roundtable

e