Residential roller coaster

Local housing prices rise, drop, rise again

Multifamily projects like the Lofts at Front Street in Norfolk cater to customer demands such as coworking spaces, says Christine Gustafson of The Breeden Co. Photo by Mark Rhodes

Multifamily projects like the Lofts at Front Street in Norfolk cater to customer demands such as coworking spaces, says Christine Gustafson of The Breeden Co. Photo by Mark Rhodes

Residential roller coaster

Local housing prices rise, drop, rise again

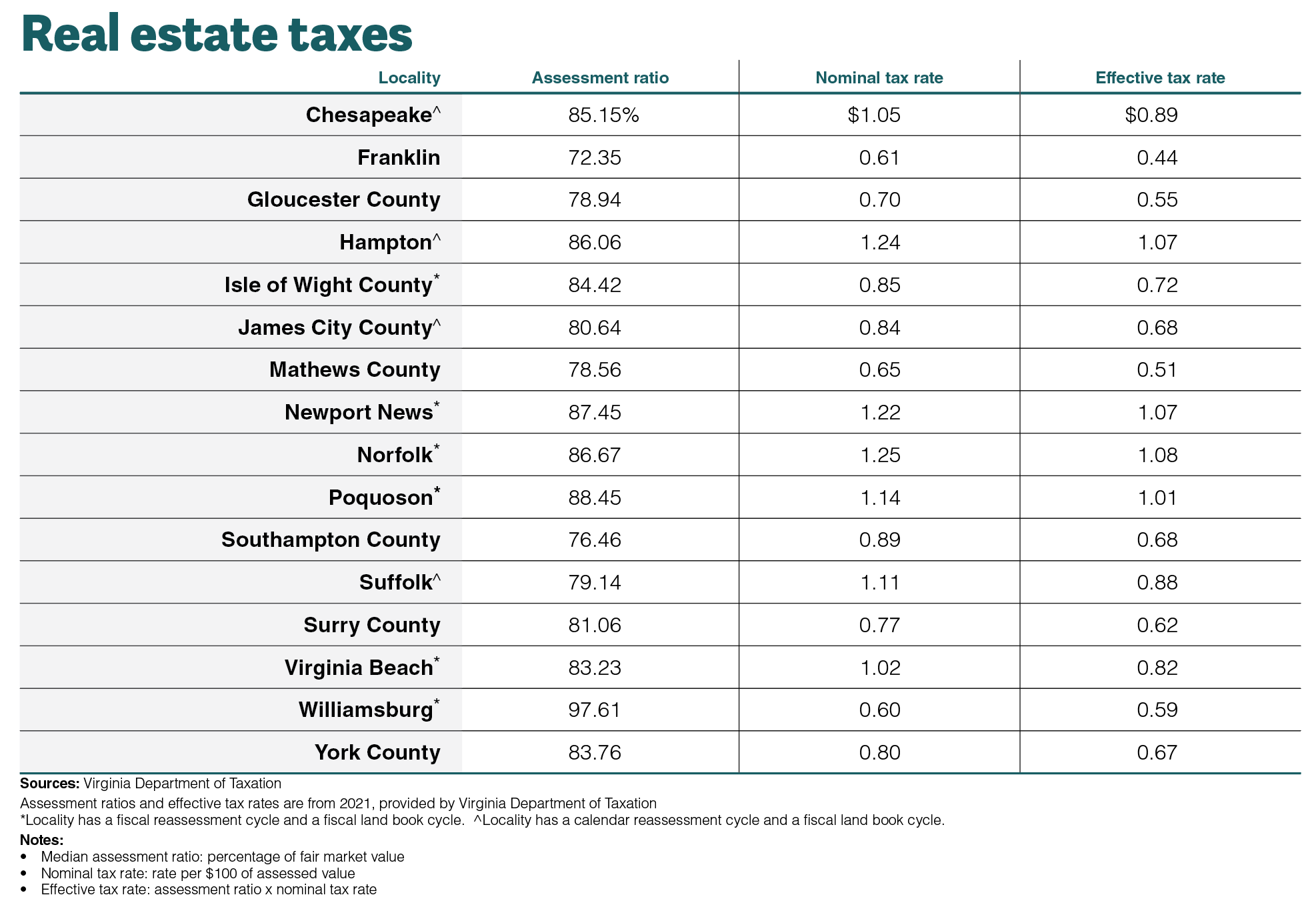

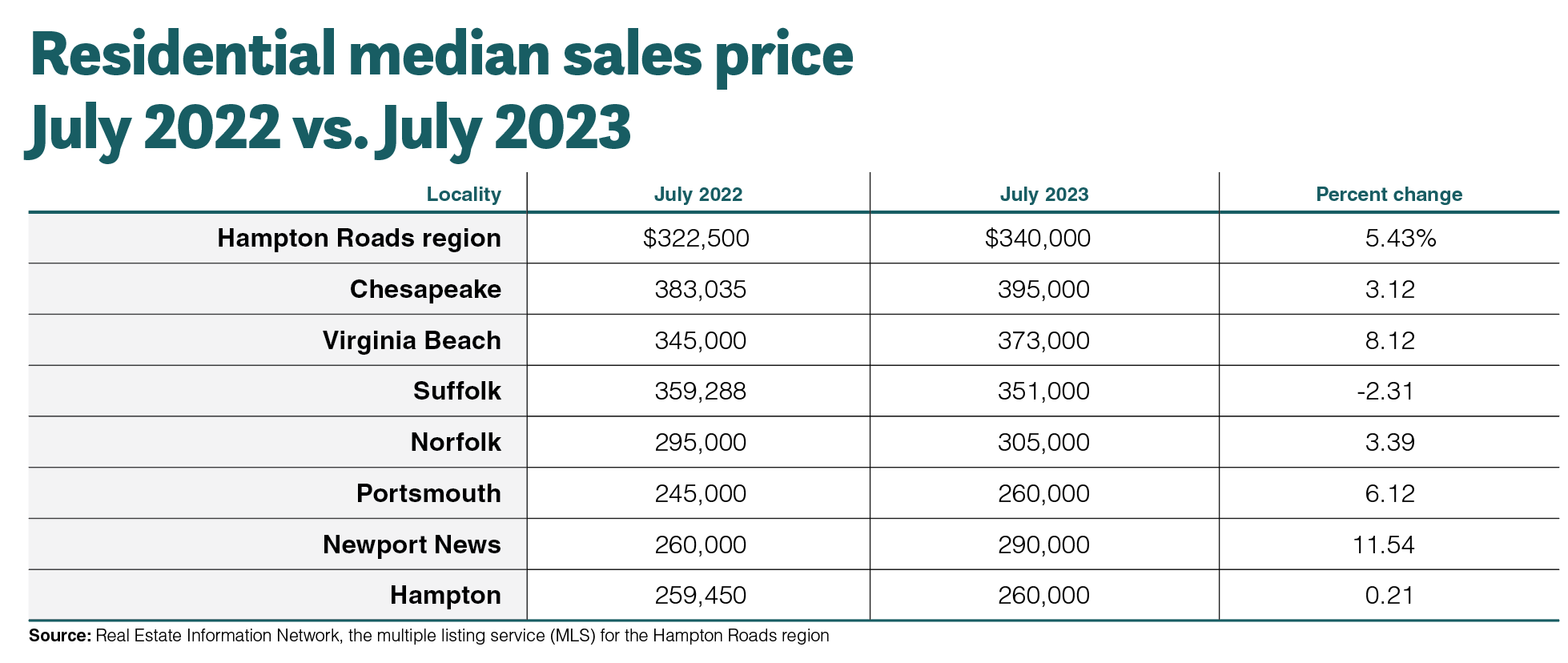

Last year began on a high note for the Hampton Roads residential real estate market, with home prices and apartment rents soaring. According to the Real Estate Information Network, monthly median rent costs rose 20.4% compared with 2021, with median rents of $1,800.

But by the fourth quarter of 2022, rent growth slowed and sales volume plummeted as the Federal Reserve raised interest rates to battle 40-year-record inflation rates.

Old Dominion University’s 2023 Hampton Roads Real Estate Market Review & Forecast, presented in March, noted that fourth-quarter rent growth was down to 5% in the region, compared with 11.6% for 2021’s fourth quarter. Paul Van, CEO and chief investment officer for Croatan Investments in Virginia Beach, said consumers’ economic health had declined, and the record high $755 million in multifamily sales in 2021’s fourth quarter plummeted 77% to $173 million in 2022’s fourth quarter.

Clark Simpson, senior vice president of Cushman & Wakefield | Thalhimer’s capital markets group in Virginia Beach, notes the effect on the market. “Last year, developers were more aggressive buying land because construction loans had lower rates and rent growth was solid,” but that’s slowed, he says, because of higher interest rates and construction costs, as well as concerns over the rate of rent growth.

By early summer, the region’s homebuying market righted itself, with median sales prices setting records in May and June, at $335,000 and $345,000 respectively, according to REIN, and Virginia Realtors reported in May that multifamily inventory rose by 1.4% in the first quarter of 2023, with the average monthly rent payment rising by $56.

While the higher cost of housing is not great for buyers or renters, the whole Hampton Roads region is not a monolith, notes Alvin “AJ” Abston, a senior market analyst for Washington, D.C.-based CoStar Group, which collects and analyzes real estate data. Micro-economies among the region’s localities were affected by inflation differently.

With regard to rentals, Virginia Beach, with a population of almost 457,700, “has been able to absorb the extra level of inventory” and has 5.6% vacancy, he says. Suffolk, on the other hand, with a population of 96,000, “has vacancy in the double digits. It’s a smaller market, so impacts are seen a lot quicker.” The submarket of Chesapeake is seeing an influx of residents, he adds. “More people are moving in who have been priced out of other areas.”

Demand is high in the affordable housing market, notes Christine Gustafson, vice president of marketing and public relations for The Breeden Co., which is redeveloping Tidewater Gardens in Norfolk. The project replaces 618 aging units, built in the 1950s, with 714 units.

“We can’t build fast enough,” she says. Breeden is also involved in The Lift & Rise in Newport News, part of the Marshall-Ridley Neighborhood Transformation Plan. The community includes a mix of 81 affordable and market-rate apartments, with rents ranging from $968 for one bedroom units to $2,250 for three bedrooms.

Breeden also has been busy at the other end of the market spectrum with the Lofts at Front Street, a luxury 258-unit building in downtown Norfolk on the Elizabeth River, with rents ranging from $1,740 to $2,685. This apartment community and others reflect customer demand, such as “Zoom rooms or coworking spaces,” Gustafson says. “What may have been a billiard table will now be a work table where people can work and meet.”

Thalhimer’s big project last year, Simpson says, was the April 2022 sale of Smitty’s Mobile Home Park in Norfolk for $9.75 million. The buyer, Bonaventure, a real estate developer in Alexandria, plans to build a 418-unit apartment and townhome complex, replacing 100 mobile homes.

“They’re Class A apartments. It will really improve that corridor,” he says.

g