Lia Tabackman// February 16, 2018//

Virginia legislators are seeking to mitigate the personal and economic consequences of their constituents’ student loan debt by creating a state-level ombudsman to troubleshoot problems and educate borrowers regarding college loans.

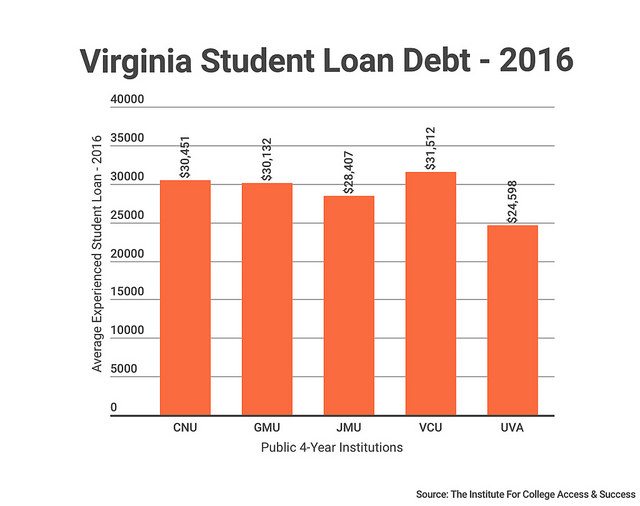

In 2017, more than 1 million Virginians owed more than $30 billion in student loan debt, state officials say. Nationally, student loan debt is more than $1.3 trillion and climbing.

“Virginians owe more on student loans than we do on credit cards or car loans, but only student loans lack consumer protections,” said Anna Scholl, executive director of Progress Virginia, a liberal advocacy group.

This week, the Senate and House each passed bills to create the Office of the Qualified Education Loan Ombudsman and establish a Borrower’s Bill of Rights. SB 394 passed the Senate unanimously on Monday; HB 1138 cleared the House, 94-5, on Tuesday.

Supporters say the ombudsman’s office would help college students secure loans and understand how to pay them off. They said the office also would establish a culture of transparency, fairness and open communication between loan providers and borrowers.

Besides reviewing and resolving borrower complaints, the ombudsman would educate loan borrowers about their rights and responsibilities and about potential problems such as late payments.

By December 2019, the ombudsman would develop a course for borrowers, half of whom are under 25.

“Too many student borrowers sign their names on the dotted line at only 18 or 19 years old without fully comprehending their rights and responsibilities associated with that debt, but also knowing that without those loans they would not be able to earn their degrees,” said Del. Maria “Cia” Price, D-Newport News, who sponsored HB 1138.

In addition, the Senate unanimously approved SB 362, which would require companies that handle the billing and other services on student loans to obtain a license from the State Corporation Commission.

Virginia is not the first jurisdiction to experiment with measures to protect student loan borrowers. Washington, D.C., established a student loan ombudsman and Borrower’s Bill of Rights a year ago.

The bipartisan approval of the legislation marks a win for Gov. Ralph Northam, who included the creation of a student loan ombudsman among his top priorities for the 2018 session.

Price also sponsored a bill that aimed to create a state agency to help Virginians refinance their student loan debt. HB 615 was killed on a 5-3 party-line vote in a House Appropriations subcommittee.